Introduction to Worksport’s Crypto Adoption

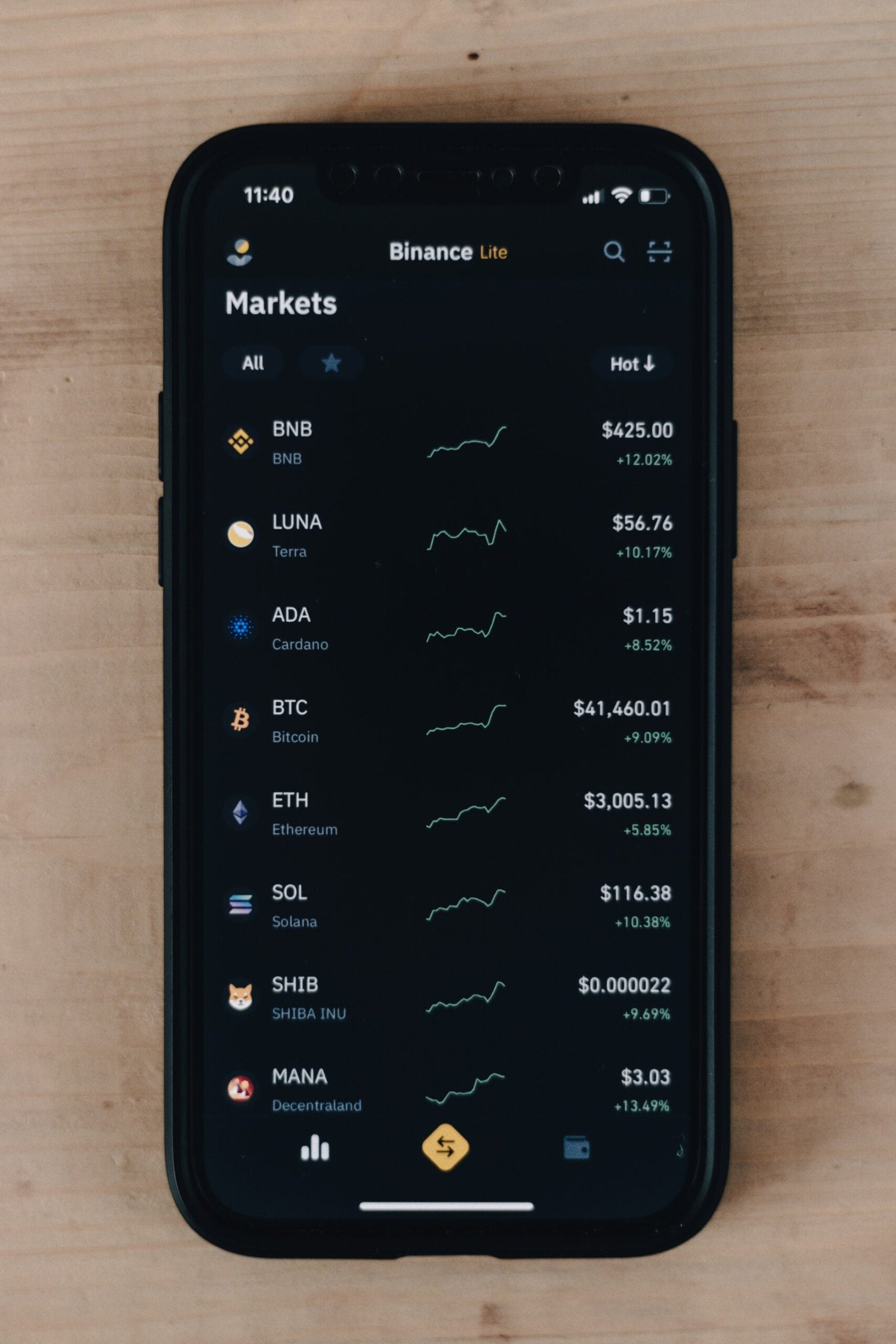

In recent developments, Worksport has made a significant announcement regarding the incorporation of cryptocurrency into its corporate treasury management strategy. Specifically, the company plans to adopt Bitcoin and XRP, reflecting a broader trend of digital currency integration among corporations. As businesses increasingly recognize the importance of cryptocurrency, Worksport positions itself at the forefront of this transformative movement.

The decision to embrace Bitcoin and XRP is not merely a financial strategy but a response to the evolving landscape of digital finance. Cryptocurrency has garnered attention for its potential to provide liquidity, facilitate seamless transactions, and offer an alternative store of value. In this light, Worksport’s choice to utilize these digital assets underscores its proactive approach to financial innovation, which is essential in today’s rapidly changing economic environment.

Worksport’s adoption of cryptocurrency stands as a testament to the increasing acceptance of Bitcoin and XRP within mainstream business operations. As more corporations acknowledge the benefits that digital currencies can bring, such as lowered transaction costs and increased global reach, Worksport is positioning itself as a pioneering entity willing to leverage these advantages. This strategic shift sets a precedent for other companies in the sector, encouraging them to explore similar pathways.

In the context of cryptocurrency, Worksport’s decisions may galvanize the adoption of digital currencies across various industries. By integrating Bitcoin and XRP into its treasury, the company not only enhances its financial adaptability but also signals to investors and stakeholders its commitment to innovative financial solutions. As Worksport embarks on this journey, it epitomizes the transformative impact of cryptocurrency on traditional corporate finance.

Details of the Corporate Strategy

In a decisive move to enhance its financial strategy, Worksport has received board approval to invest up to $5 million in Bitcoin and XRP, two prominent cryptocurrencies. This investment represents a calculated approach, allowing for a maximum allocation of 10% of the company’s excess operational cash. The decision illustrates Worksport’s commitment to adapting to the evolving financial landscape and embracing digital currencies as part of its corporate treasury strategy.

The allocation of funds towards Bitcoin and XRP aligns with broader trends in the investment community, where cryptocurrency is gaining traction as a viable asset class. By diversifying its reserve assets, Worksport aims to mitigate risks associated with volatility in traditional markets while tapping into the potential for significant returns that cryptocurrencies can offer. The integration of these digital assets reflects a growing recognition of the role that cryptocurrencies can play in corporate finance, particularly as many firms seek to balance liquidity and investment opportunities.

Moreover, this strategy highlights Worksport’s innovative approach to capital management, particularly in an era marked by rapid technological advancements. The management believes that having a presence in the cryptocurrency market not only enhances its financial positioning but also reinforces its image as a forward-thinking company. As the cryptocurrency ecosystem continues to evolve, Worksport stands to benefit from the increased liquidity and operational flexibility that comes with holding Bitcoin and XRP in its treasury.

This strategic initiative underlines Worksport’s objective to align its financial strategies with contemporary practices, enabling the organization to remain competitive. As companies worldwide are beginning to recognize the advantages of integrating digital currencies into their financial operations, Worksport is poised to capitalize on this shift, ultimately enhancing its financial stability and growth potential in the long run.

CEO’s Vision and Market Response

In the rapidly evolving landscape of cryptocurrency, CEO Steven Rossi of Worksport has articulated a forward-thinking vision regarding the adoption of digital currencies such as Bitcoin and XRP within corporate treasury operations. His comments reflect a keen understanding of market trends and a strategic approach towards enhancing operational efficiency and maximizing shareholder value. By incorporating cryptocurrencies into the financial framework of the company, Worksport aims to align itself with innovation and the growing acceptance of digital assets in mainstream finance.

The recent surge of Bitcoin surpassing the $100,000 mark has captured significant attention and prompted discussions around its implications for corporate treasury management. Rossi emphasized that such milestones in Bitcoin’s trajectory not only highlight the resilience and potential of cryptocurrencies but also signal to shareholders the financial viability and attractiveness of integrating these assets into their investment strategy. XRP, with its notable gains, further demonstrates the diverse opportunities available in the cryptocurrency market, making it a compelling choice for companies looking to diversify their portfolios.

Market analysts have responded positively to Worksport’s strategic pivot towards cryptocurrency adoption. The stock performance post-announcement indicates a surge in investor confidence, driven by the anticipation of enhanced liquidity and financial flexibility that digital currencies can provide. Rossi’s insights underline the importance of being proactive in addressing market dynamics, asserting that the integration of Bitcoin and XRP can transform operational practices and position the company favorably amidst increasing competition. By leaning into the insights gained from the cryptocurrency market, Rossi is steering Worksport towards a trajectory aimed at innovation, sustainability, and long-term growth within the realm of digital finance.

Benefits of Cryptocurrency Transactions

In recent years, the adoption of cryptocurrency has garnered significant attention from both investors and corporations alike. For Worksport, integrating digital currencies like Bitcoin and XRP into its operations presents numerous benefits that can enhance overall performance and customer satisfaction. One of the primary advantages of utilizing cryptocurrency transactions is the increased efficiency they offer. Traditional banking systems often result in lengthy transaction times, particularly for cross-border payments. In contrast, cryptocurrencies facilitate near-instantaneous transactions, allowing Worksport to streamline its financial operations and improve cash flow management.

Furthermore, incorporating cryptocurrency can lead to substantial cost savings. Traditional payment processing fees can be relatively high, often reaching up to 3-5% per transaction depending on the payment method. However, by accepting cryptocurrencies, Worksport can reduce these fees by as much as 37%. This reduction not only lowers operational costs but also allows the company to allocate resources toward growth initiatives and innovation. As a result, the financial advantages are twofold: reduced costs and increased agility in handling payments.

Another significant benefit of embracing cryptocurrency transactions is the enhanced convenience it offers to customers. A growing segment of the population is becoming increasingly familiar with digital currencies and appreciates the ability to use them in everyday transactions. By enabling customers to purchase Worksport products using Bitcoin or XRP, the company can cater to a broader audience and attract tech-savvy consumers who prioritize modern payment methods. This alignment with evolving consumer preferences positions Worksport favorably in the competitive landscape, potentially boosting sales and brand loyalty.

In conclusion, the adoption of cryptocurrency, particularly Bitcoin and XRP, offers Worksport substantial benefits, including transaction efficiency, reduced processing fees, and improved customer convenience. These advantages can facilitate a more robust operational framework, ultimately fostering the company’s growth and sustainability in the ever-evolving marketplace.

Integration of Cryptocurrency into E-Commerce

Worksport’s strategic shift towards embracing cryptocurrencies, specifically Bitcoin and XRP, signals a transformative move within the e-commerce landscape. This integration is aimed at enhancing customer interactions, payment flexibility, and the overall user experience. As more consumers become accustomed to digital currencies, the incorporation of Bitcoin and XRP as payment options can foster a more engaging shopping environment. By offering these cryptocurrency solutions, Worksport positions itself to attract a wider audience that values innovative payment methods.

The operational advantages that cryptocurrencies provide to Worksport are not negligible. Transactions conducted via Bitcoin and XRP can lead to quicker payment processing times, thus improving cash flow. Furthermore, cryptocurrencies have the potential to minimize transaction fees typically associated with traditional banking systems and credit card payments. Such financial efficiency can allow Worksport to redirect resources towards further development of their product offerings and customer service initiatives, ultimately contributing to a more robust e-commerce platform.

Moreover, adopting cryptocurrency also enhances customer trust and loyalty. As consumers increasingly seek transparency and security in their transactions, the blockchain technology underpinning Bitcoin and XRP offers an immutable and auditable transaction record. This aspect is particularly appealing to consumers who are wary of fraud or data breaches, reinforcing Worksport’s reputation as a forward-thinking brand that prioritizes user security.

As Worksport continues to adapt its e-commerce strategy, integrating cryptocurrencies represents a crucial element of their broader vision. This initiative not only aligns with current trends within the fintech landscape but also positions Worksport as a leader in the e-commerce space that embraces the potential of cryptocurrency to redefine customer experiences. In conclusion, the incorporation of Bitcoin and XRP into Worksport’s operations could pave the way for new opportunities in customer engagement and operational efficiency, establishing the brand as a key player in the evolving cryptocurrency market.

Interest Earnings Conversion Strategy

With the evolving landscape of digital finance, Worksport has strategically chosen to convert interest earnings from its cash reserves into cryptocurrency, specifically Bitcoin and XRP. This initiative not only reflects a forward-thinking approach but also aims to enhance the company’s financial performance and secure its position in the competitive industry. By adopting cryptocurrencies, Worksport capitalizes on the inherent volatility and potential for higher returns compared to traditional cash holdings.

The rationale behind this conversion strategy is multifaceted. First and foremost, the cryptocurrency market, particularly Bitcoin, has demonstrated a remarkable appreciation over the years, representing an opportunity for significantly higher interest yields. By reallocating these interest earnings into Bitcoin, Worksport not only boosts its potential returns but also diversifies its asset base. Similarly, the integration of XRP into the corporate treasury strategy aligns with the company’s vision of leveraging blockchain technologies, which are integral to the future of financial transactions.

Moreover, incorporating cryptocurrencies into the treasury allows Worksport to enhance its liquidity management practices. As cryptocurrencies become increasingly accepted as a medium of exchange, the company positions itself to capitalize on emerging payment opportunities and streamline financial transactions. This approach reflects an adaptive response to market demands, enabling Worksport to stay ahead in technological advancements while pursuing traditional revenue streams.

Overall, the conversion of interest earnings into Bitcoin and XRP represents a strategic alignment with Worksport’s broader financial objectives. This initiative not only reflects a commitment to innovation but also underscores the company’s proactive stance in responding to the dynamic nature of the cryptocurrency market. As Worksport continues to navigate this evolving financial landscape, the implications of such strategies could significantly influence its future growth and market positioning.

Future Capital Raises and Cryptocurrency Acquisition

As Worksport continues to innovate within the corporate treasury realm, the strategic allocation of proceeds from future capital raises is expected to play a critical role in the company’s cryptocurrency acquisition plans. By leveraging funds raised through various channels, Worksport aims to bolster its treasury with significant holdings in Bitcoin and XRP, aligning itself with modern trends in digital asset management. This approach bears resemblance to tactics employed by industry leaders such as MicroStrategy and Marathon Digital, both of which have integrated substantial cryptocurrency investments into their corporate strategies.

MicroStrategy, renowned for its aggressive accumulation of Bitcoin, has demonstrated the viability of utilizing capital raised from equity and debt offerings to purchase cryptocurrency. This model has proven effective, positioning the company as a major Bitcoin holder while simultaneously enriching its balance sheet. Likewise, Marathon Digital has followed suit, employing a similar methodology that merges capital raises with cryptocurrency purchases to foster growth. These companies illustrate the importance of cryptocurrency in enhancing liquidity and driving corporate value.

For Worksport, the potential benefits of adopting a cryptocurrency-centric treasury strategy are manifold. Bitcoin and XRP, as leading digital currencies, not only provide diversification but also facilitate participation in a burgeoning market. Given the current trajectory of the cryptocurrency space, capital raised could be judiciously allocated to further enhance Worksport’s position in the sector. An investment in these digital assets may also yield long-term returns, aligning with the company’s goals for sustainable growth and financial resilience. It will be crucial for Worksport to strategically navigate this evolving landscape as it looks toward future capital raises and the prospect of deepening its investment in cryptocurrency.

Industry Trends in Corporate Cryptocurrency Adoption

The adoption of cryptocurrency by businesses has witnessed significant momentum in recent years, with companies increasingly recognizing the potential benefits of integrating digital assets such as Bitcoin and XRP into their financial strategies. Major corporations are beginning to view cryptocurrencies not only as investment vehicles but also as viable alternatives for cash management and treasury operations. This shift is indicative of a broader trend across various industries, where organizations are adapting to the evolution of financial technology and changing consumer preferences.

For instance, companies like Tesla and MicroStrategy have made headlines for their substantial investments in Bitcoin, underscoring a growing acceptance of this cryptocurrency as a legitimate asset class. Additionally, firms such as PayPal have embraced digital currencies, allowing customers to transact using Bitcoin, Ethereum, and other cryptocurrencies. These examples reflect a wider trend, where businesses are exploring the functionality of cryptocurrencies beyond speculative trading.

The implications for corporate finance and treasury strategies are multi-faceted. Organizations are now contemplating the potential efficiency gains that can arise from using cryptocurrencies for payments, cross-border transactions, and liquidity management. The decentralized nature of cryptocurrencies like Ripple offers companies an innovative way to mitigate the risks associated with traditional banking systems, particularly in global operations. Moreover, integrating cryptocurrency into corporate treasury can enhance transparency and reduce costs associated with fees and transaction times.

As the landscape of finance continues to evolve, companies similar to Worksport are likely to follow suit, adopting digital currencies as part of their financial infrastructure. This trend is expected to lead to greater regulatory clarity, helping to streamline the integration of cryptocurrencies into corporate accounting and compliance practices. Overall, the rising adoption of cryptocurrency in the corporate sphere signals a significant transformation in how companies manage their financial resources and engage with the broader economic ecosystem.

Conclusion: Worksport’s Innovative Path Forward

In light of the recent strategic shift by Worksport towards the adoption of Bitcoin and XRP, it is essential to recognize the potential implications this move holds not only for the company but also for the broader cryptocurrency market. By integrating digital currencies such as Bitcoin and XRP into its corporate treasury strategy, Worksport is positioning itself at the forefront of a rapidly evolving financial landscape. This adoption reflects a growing acceptance of cryptocurrencies as viable assets for corporate liquidity management, signaling a trend that could influence other companies in similar sectors.

The embrace of cryptocurrencies speaks to Worksport’s innovative approach to financial management, showcasing a willingness to leverage modern technologies to enhance operational efficiency and expand financial flexibility. As companies explore various methods to diversify their treasury reserve assets, Bitcoin and XRP offer distinct advantages, including speed of transactions and a hedge against inflationary pressures. Furthermore, this strategic shift may attract forward-thinking investors who value companies that prioritize technological advancements and sustainability.

Moreover, Worksport’s decision could herald a new era for the adoption of digital currencies in corporate environments. The ability to utilize cryptocurrencies may empower companies to streamline their payment processes, reduce transaction fees, and capitalize on the growing acceptance among consumers and suppliers alike. Ultimately, this pioneering move by Worksport serves as a case study for other businesses considering similar pathways, suggesting that the integration of cryptocurrencies into corporate finance is not merely a trend but potentially a long-term strategy with significant benefits.

As the landscape of corporate treasury management continues to evolve, it is crucial for stakeholders to consider the implications of such innovations. The decision by Worksport to adopt Bitcoin and XRP may inspire other organizations to rethink their financial strategies and embrace the future of digital transactions.