Introduction

The cryptocurrency market has recently witnessed remarkable developments, particularly with Bitcoin and Ethereum exchange-traded funds (ETFs) experiencing unprecedented inflows. This surge in capital is indicative of a broader shift in investor sentiment towards cryptocurrencies, as Bitcoin approaches the significant milestone of six-figure valuations. As Bitcoin’s price trajectory continues to ascend, both seasoned investors and market newcomers are increasingly turning their attention to cryptocurrency investment options, prominently including ETFs.

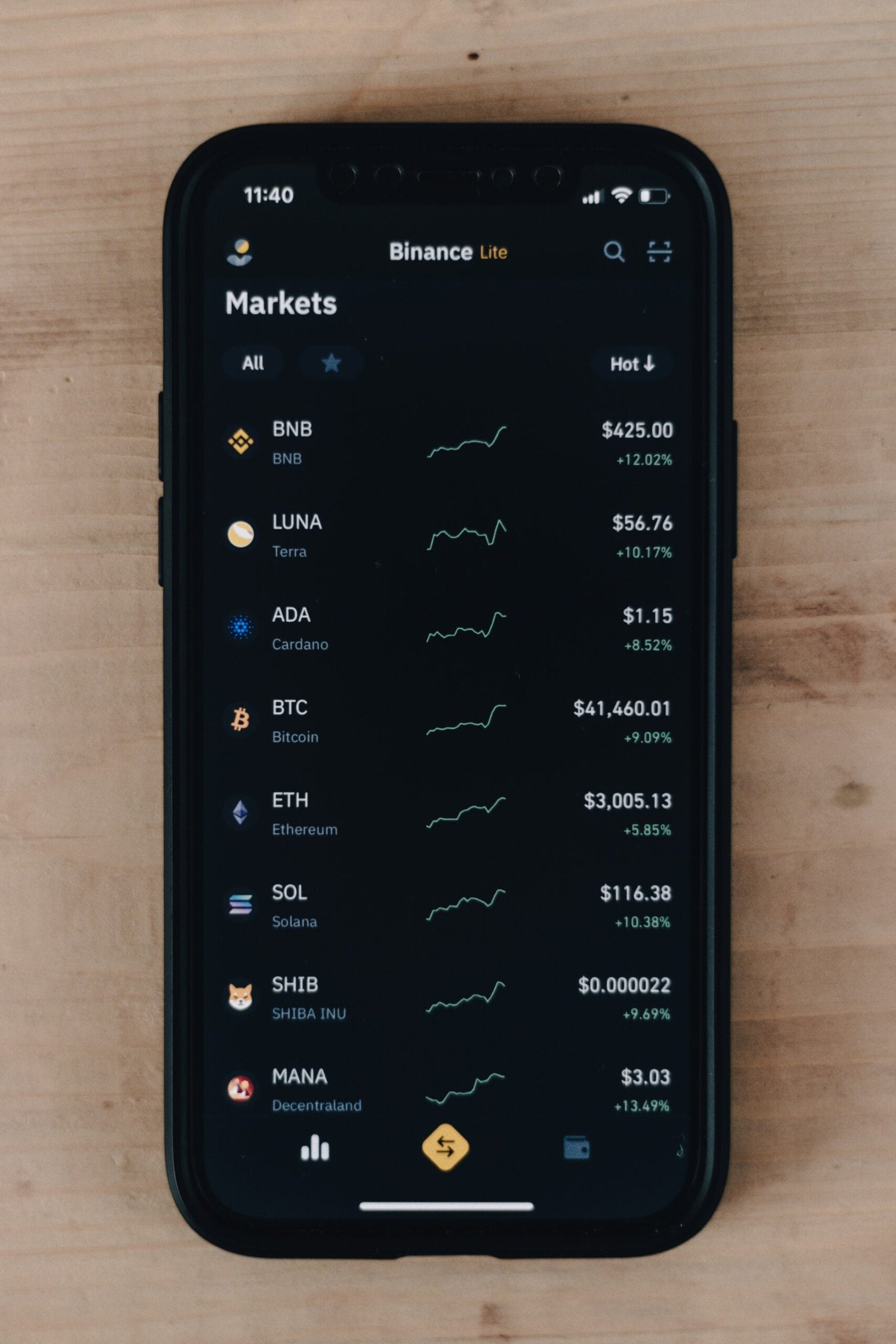

Bitcoin, often referred to as BTC in trading circles, remains the flagship cryptocurrency, and its influence extends across the entire digital asset landscape. With the recent record inflows into Bitcoin ETFs, it is evident that institutional and retail investors alike are recognizing the potential value of BTC as a viable investment asset. This influx of capital represents not only a vote of confidence in Bitcoin but also highlights the growing acceptance of cryptocurrencies in mainstream finance.

Furthermore, Ethereum, as the second-largest cryptocurrency by market capitalization, has also reported substantial inflows into its ETFs, signaling a complementary interest in this innovative blockchain platform. Ethereum’s existing utility and ongoing developments, such as its transition to proof-of-stake, have captured the attention of many investors who are seeking diversification within the cryptocurrency realm.

The record-breaking inflows into Bitcoin and Ethereum ETFs reflect an evolving market landscape where traditional investment vehicles are increasingly accommodating digital assets. This significant uptick in investor participation indicates a fundamental shift in how cryptocurrencies are perceived, with more individuals viewing them as long-term investment alternatives. Consequently, this trend may lead to a more robust market structure for BTC and other cryptocurrencies, further paving the way for wider adoption in the coming years.

Record Inflows in Bitcoin ETFs

The recent surge in the inflows into U.S. spot Bitcoin ETFs has been nothing short of remarkable, with a staggering total of $556.82 million pouring into this segment. This influx of capital not only signifies growing investor interest but also highlights a noticeable shift in market sentiment towards cryptocurrency, particularly Bitcoin. Leading the charge is BlackRock’s iBIT ETF, which has accumulated a significant share of the capital, showcasing its appeal among investors who are increasingly recognizing Bitcoin as a viable asset class.

The substantial inflow into Bitcoin ETFs is indicative of investors seeking exposure to Bitcoin without the challenges associated with directly purchasing and storing the cryptocurrency. ETFs provide a regulated and straightforward avenue for individuals and institutional investors to invest in Bitcoin, ultimately enhancing market accessibility. This trend is further complemented by a growing acceptance of cryptocurrencies by traditional financial institutions, which reinforces the trend toward legitimacy in the market.

Moreover, these inflows play a crucial role in shaping the overall dynamics of the cryptocurrency market. They not only provide liquidity but also contribute to price stability, as increased demand for Bitcoin leads to upward pressure on its value. As Bitcoin continues to capture the attention of a broader audience, the inflow into ETFs signals a maturation of the cryptocurrency market, fostering greater investor confidence. This can result in even further investments as investors look to capitalize on the potential of Bitcoin, especially with the anticipation of reaching significant price milestones.

Ethereum ETFs See Significant Gains

In recent weeks, Ethereum exchange-traded funds (ETFs) have demonstrated remarkable performance, drawing significant interest from institutional investors. Notably, these ETFs experienced inflows amounting to $167.62 million, a clear indication of the growing enthusiasm for Ethereum as an investment vehicle. This trend is particularly intriguing given the surging demand for cryptocurrency investment options, paralleling the already notable interest in Bitcoin ETFs.

Among the various Ethereum ETFs, BlackRock’s ETHA ETF has emerged as a frontrunner, garnering a substantial share of the inflows. The popularity of Ethereum can be attributed to several factors, including its potential use in decentralized finance (DeFi) applications and the widespread adoption of smart contracts, which further broaden its utility within the blockchain ecosystem. BlackRock’s robust management and reputation have played a crucial role in instilling confidence among investors, making ETHA a preferred choice for those looking to capitalize on the potential gains of Ethereum.

Other notable players in the Ethereum ETF space include Fidelity and Grayscale, both of which have also reported significant inflows in their respective funds. Fidelity’s enhancing product offerings in the realm of cryptocurrency, along with Grayscale’s established presence in the market, highlights a collective shift among institutional investors towards Ethereum. The combination of institutional backing and increasing market interest signifies that Ethereum is not merely an alternative to Bitcoin, but a compelling investment opportunity in its own right.

The upswing in Ethereum ETF inflows reflects a broader acceptance and growing interest in cryptocurrencies, with institutional investors increasingly diversifying their portfolios to include both Bitcoin and Ethereum. This surge is indicative of the evolving financial landscape, where digital assets are becoming integral components of conventional investment strategies.

Comparative Analysis of Major ETFs

The rapid evolution of cryptocurrency investment vehicles has led to a significant increase in the popularity of Exchange-Traded Funds (ETFs) focused on Bitcoin and Ethereum. As the cryptocurrency market gains momentum, major financial institutions including BlackRock, Fidelity, and Grayscale have positioned themselves to capitalize on the growing demand for these digital assets. A detailed analysis of the inflow data and overall assets under management reveals critical insights into their respective strategies and market positions.

BlackRock has emerged as a formidable player in the ETF landscape, launching a Bitcoin ETF that quickly garnered substantial investor interest. This fund has seen remarkable inflows, positioning BlackRock as a leader in the cryptocurrency ETF market. Its strategy emphasizes diversification and institutional accessibility, appealing to traditional investors looking to gain exposure to BTC without directly owning the asset. The firm’s significant investments into blockchain technology also reflect a long-term commitment to cryptocurrency, further bolstering investor confidence.

Fidelity, a well-known player in asset management, has entered the fray with its own Bitcoin and Ethereum ETFs. Fidelity’s approach includes a strong focus on security and regulatory compliance, which is reassuring for risk-averse investors. Despite having fewer total assets under management compared to BlackRock, Fidelity has experienced steady inflows, reflecting its established reputation and dedicated customer base in the financial sector.

Grayscale has long been a key competitor in digital asset management, boasting the largest Bitcoin trust. Its diversified product offerings allow investors to access both Bitcoin and Ethereum assets through easier means. However, Grayscale has faced challenges with regulatory scrutiny, leading to some notable outflows. Nevertheless, its strategic emphasis on client education and market positioning supports its ability to adapt to emerging trends in the cryptocurrency space.

The comparative analysis of these major players illustrates not only their individual strategies but also highlights the overall growth trajectory of Bitcoin and Ethereum ETFs. Such dynamics indicate a bullish sentiment surrounding these cryptocurrencies as they approach significant price milestones.

Impact on Bitcoin and Ethereum Prices

The recent surge in exchange-traded funds (ETFs) related to Bitcoin and Ethereum signifies a growing interest among institutional investors, which has notably impacted the prices of these leading cryptocurrencies. Historical trends suggest a direct correlation between substantial inflows into ETFs and subsequent increases in the prices of the underlying assets. As Bitcoin approaches the significant milestone of $100,000, market dynamics indicate a bullish trend that many experts believe will trigger a new wave of investor enthusiasm.

One of the key factors contributing to Bitcoin’s price surge is the heightened legitimacy and accessibility that ETFs provide. By enabling more traditional investors to gain exposure to Bitcoin in a regulated environment, ETFs represent a pivotal shift in the cryptocurrency market. The influx of institutional capital not only reinforces Bitcoin’s standing as a digital asset but also fosters an environment conducive to price appreciation. Consequently, the drive towards the $100,000 mark is reflective of broader market confidence as institutional participation continues to rise.

In parallel, Ethereum has not been left out of this trend. As more ETFs are introduced, the demand for Ethereum is expected to increase correspondingly, particularly given the network’s ongoing developments and its position as a leading platform for decentralized applications. With growing institutional backing, both Bitcoin and Ethereum stand to benefit from increased volatility in the short term, followed by stabilization at higher price levels.

As the market navigates through this evolving landscape, the implications of institutional support are undeniable. Price trajectories for Bitcoin and Ethereum in the coming months are likely to be influenced by macroeconomic factors and investor sentiment. Such institutional engagement is expected to yield positive price movements, further entrenching these cryptocurrencies as formidable assets in investment portfolios.

Institutional Interest in Cryptocurrency

The increasing inflows into Bitcoin and Ethereum exchange-traded funds (ETFs) reflect a significant shift in institutional interest towards cryptocurrency as a viable asset class. In recent years, many institutional investors have started to embrace cryptocurrencies, traditionally viewed as speculative investments, as they recognize the potential for digital assets to complement their portfolios. The record-breaking inflows into these ETFs indicate a growing confidence among institutional investors concerning the viability of bitcoin and other cryptocurrencies in the mainstream financial landscape.

This trend demonstrates how institutional interest is reshaping the market perception of cryptocurrencies. By integrating bitcoin and other digital assets into institutional investment strategies, firms are fostering legitimacy in this emerging sector. Furthermore, this influx of capital is likely to lead to increased volatility, improved liquidity, and a more robust trading environment, ultimately paving the way for broader acceptance in financial markets. The significant participation from institutional players could also enhance the credibility of bitcoin, as it signals maturity and a progressive attitude towards regulations surrounding cryptocurrencies.

As institutions begin to allocate substantial funds towards cryptocurrency investments, it is critical to consider the implications for long-term adoption and regulation. The influx of institutional money may compel regulators to establish more comprehensive frameworks governing the cryptocurrency market. This could enhance transparency and instill confidence among retail investors, streamlining the adoption of digital assets more broadly. The emergence of institutional interest also raises discussions about the sustainability and future of bitcoin as an asset class, further encouraging dialogue among policymakers, investors, and industry stakeholders about the path forward for cryptocurrency in a rapidly evolving financial ecosystem.

ETFs as a Vehicle for Cryptocurrency Investment

Exchange-Traded Funds (ETFs) have emerged as a popular vehicle for investing in cryptocurrencies, providing a structured means for both retail and institutional investors to gain exposure to the crypto market. One of the primary advantages of cryptocurrency ETFs, such as those focusing on Bitcoin or Ethereum, is their accessibility. Investors can buy and sell shares of these ETFs on traditional stock exchanges, making it simpler for those who may be hesitant to navigate the complexities of direct cryptocurrency purchases. This accessibility plays a crucial role in broadening the investor base, attracting those who are already familiar with stock trading but are cautious about the intricacies of cryptocurrency exchanges.

Another notable benefit is the enhanced security that ETFs provide. By investing in an ETF, investors are not required to manage their private keys or digital wallets, significantly reducing the risk associated with hacks or theft, which have historically plagued the cryptocurrency space. The ETF’s underlying assets are managed by professionals, often within regulated frameworks, offering an extra layer of protection for those entering the volatile world of cryptocurrencies.

Additionally, ETFs facilitate diversified exposure to cryptocurrencies, which is essential in a market as unpredictable as that of Bitcoin and other cryptocurrencies. Investors can spread their risk by purchasing shares in an ETF that may hold a variety of digital assets, rather than placing all their capital into a single cryptocurrency. This diversification can help mitigate losses during downturns in specific assets while capitalizing on the overall growth of the cryptocurrency market.

In conclusion, the advantages of using ETFs as a vehicle for cryptocurrency investment include increased accessibility, security, and diversification. As interest in cryptocurrencies like Bitcoin continues to rise, ETFs will likely play an increasingly pivotal role in shaping how investors approach this dynamic market.

Future Trends in Crypto ETFs

The growing interest in cryptocurrency exchange-traded funds (ETFs) such as those for Bitcoin has significantly shaped the landscape of the financial market. As institutional investors, retail traders, and the broader public become increasingly engaged with digital assets, we can expect several notable trends in the cryptocurrency ETF space in the coming years.

One of the most crucial factors affecting the future of crypto ETFs is regulatory evolution. As lawmakers and regulatory bodies attempt to keep pace with the rapid developments in the crypto market, we may see new guidelines designed to enhance investor protection and ensure market stability. This regulatory framework could facilitate the introduction of additional cryptocurrency ETFs that broaden investor access to various digital assets beyond Bitcoin, such as Ethereum and various altcoins. The potential approval of ETFs based on a wider array of cryptocurrencies may lead to a more diversified market, encouraging greater participation from both institutional and retail investors.

Moreover, as market maturity continues, we are likely to see innovative product offerings emerge. These products could include leveraged Bitcoin ETFs, which would allow investors to gain enhanced exposure to BTC price movements without the complexities of directly holding the cryptocurrency. Additionally, thematic ETFs focusing on specific sectors of the cryptocurrency ecosystem, such as decentralized finance (DeFi) or blockchain technology, might gain traction. As the cryptocurrency landscape evolves, the development of such ETFs could help investors capitalize on various market segments.

Lastly, the integration of advanced technology into crypto ETFs may transform how investors interact with these products. From enhanced trading platforms to better analytics, technological innovation will likely play a vital role in shaping the future of cryptocurrency ETFs, ultimately leading to increased efficiency and better informed investment strategies.

Conclusion

In light of the recent developments within the cryptocurrency landscape, it has become increasingly evident that the inflows into Bitcoin and Ethereum ETFs are monumental. The surge in investments reflects not only a growing acceptance of digital currencies but underscores the mainstreaming of Bitcoin and its counterparts in the investment sphere. As individuals and institutions alike pivot towards more regulated avenues for cryptocurrency investment, ETFs present an appealing option that combines traditional investment frameworks with the innovative nature of cryptocurrencies.

The record inflows into these funds are indicative of heightened investor confidence amidst the ongoing volatility typically associated with the crypto market. The historical significance of Bitcoin is reinforced by its resilience, maintaining its status as a digital asset synonymous with innovation and potential return. Furthermore, Ethereum’s emergence as a backbone for decentralized applications presents compelling reasons for investors to diversify their portfolios with a focus on cryptocurrency.

It is essential to recognize that these developments represent more than mere statistics—they reflect a paradigm shift in how cryptocurrencies are perceived by the broader financial community. The established frameworks surrounding Bitcoin and Ethereum ETFs facilitate a clearer pathway for new investors entering the cryptocurrency space, potentially leading to greater liquidity and capital inflow. As market sentiment continues to evolve, keeping abreast of these changes will be crucial for any investor considering the merits of BTC or the broader cryptocurrency sector.

Investors are encouraged to stay informed about ongoing developments and to conduct thorough research before making investment decisions. Given the pace at which the cryptocurrency narrative is evolving, ongoing engagement with credible sources of information will be paramount in navigating this digital frontier. The future of cryptocurrency investment, particularly in the form of ETFs, holds extensive possibilities that merit close observation.