Introduction to the Crypto Boom

In recent months, the cryptocurrency economy has experienced an impressive surge, with a total market capitalization reaching a staggering $3.29 trillion. This significant milestone reflects the rising interest among investors and traders in various digital currencies, particularly altcoins such as XLM, ADA, and XRP, which have increasingly taken center stage as alternative investment options to Bitcoin.

The driving forces behind this remarkable growth can be attributed to several factors. First, there has been an upswing in institutional investment in cryptocurrencies, with major financial institutions and corporations recognizing the potential of blockchain technology and its applications. This influx of capital has provided the industry with increased legitimacy and stability, fostering heightened confidence among retail investors. Additionally, the successful implementation of decentralized finance (DeFi) platforms and non-fungible tokens (NFTs) has further showcased the versatility and utility of altcoins, leading to greater demand and market enthusiasm.

Furthermore, macroeconomic conditions, marked by inflationary pressures and uncertain traditional financial markets, have prompted many investors to seek alternative investment vehicles. The decentralized nature of cryptocurrencies offers a hedge against economic instability, making digital assets, particularly those built on robust blockchain networks, attractive to a broader audience. Altcoins have capitalized on this trend, with projects like Stellar (XLM) and Cardano (ADA) offering innovative solutions and community-driven initiatives that resonate with investors looking for potential high returns.

This week’s developments clearly illustrate the dynamic landscape of cryptocurrencies, where altcoins are not just overshadowed by Bitcoin but are carving out their niche in the burgeoning crypto economy. As we delve deeper into the specifics, it becomes evident that the performance of these digital assets plays a crucial role in defining the current state of the market.

Bitcoin and Ethereum Lead the Charge

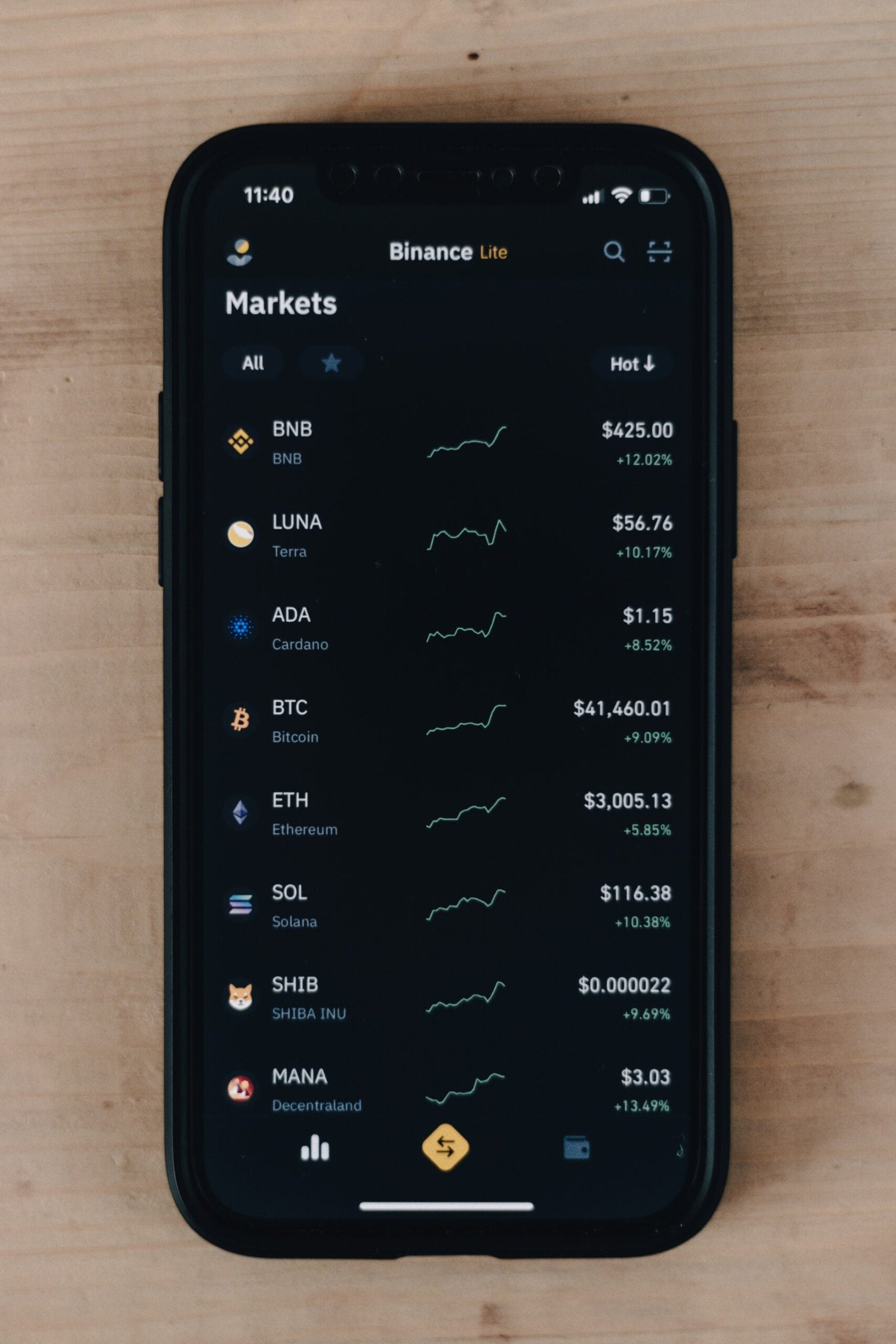

As the cryptocurrency market continues to evolve, Bitcoin and Ethereum remain at the forefront, driving significant movements within the broader financial landscape. Over the past week, Bitcoin has experienced a remarkable percentage increase, reflecting a renewed investor confidence as it approaches key resistance levels. Currently, Bitcoin is trading at a notable high compared to its recent averages, allowing it to reclaim a substantial portion of the market capitalization, solidifying its dominance.

Ethereum, not to be outdone, has also witnessed a considerable surge in price, with its recent performance showcasing the resilience of decentralized finance (DeFi) applications that operate on its blockchain. This increase can largely be attributed to the recent developments in Ethereum 2.0 and the anticipated scalability solutions that have caught the attention of both institutional and retail investors alike. The continuing growth of Ethereum is drawing interest towards altcoins, as investors seek to diversify their portfolios amidst shifting market dynamics.

The influence of these two pioneers is particularly significant, as their market movements tend to dictate the trends observed in a variety of altcoins, including XLM, ADA, and XRP. When Bitcoin and Ethereum rise, there is often a subsequent ripple effect that elevates the performance of numerous cryptocurrencies within the ecosystem. This relationship is crucial for investors to understand, especially when considering the allocation of assets across different forms of cryptocurrency.

The substantial growth of Bitcoin and Ethereum not only reinforces their status as leaders in the blockchain space but also sets the stage for increased attention toward altcoins in the coming weeks. With continued interest in the potential of XLM, ADA, and XRP, alongside their respective blockchain applications, the market may see a shift in investor focus, prompting a larger dialogue around emerging technologies and use-cases within the cryptocurrency arena.

Noteworthy Altcoin Performance

The realm of altcoins has seen remarkable performance, particularly in the wake of the crypto economy reaching an impressive market capitalization of $3.29 trillion. Among the standout performers are Mantra DAO (OM), Stellar (XLM), and Hedera Hashgraph (HBAR). These altcoins have not only captured significant attention but have also demonstrated impressive price gains that reflect their growing traction in the market.

Mantra DAO (OM) has experienced a surge in value, attributed largely to the increasing adoption of decentralized finance (DeFi) solutions. As users increasingly look for alternatives to traditional financial systems, OM offers a governance framework that allows users to participate in valuable staking opportunities. This utility within the DeFi space has propelled its market dynamics and attracted both institutional and retail investors.

Stellar (XLM) has also seen a noteworthy upswing, driven by its unique position in facilitating cross-border transactions. The recent partnerships aimed at boosting financial inclusion, particularly in emerging markets, have significantly enhanced the perceived value of XLM. As companies recognize the potential of blockchain technology for simplifying transactions, XLM’s role becomes increasingly relevant, causing a ripple effect on its market price.

Meanwhile, Hedera Hashgraph (HBAR) continues to impress with its focus on scalability and security, making it an appealing choice for developers designing enterprise-level applications. Increased interest from major corporations exploring blockchain solutions has contributed positively to HBAR’s performance. Its distinct consensus mechanism offers a promising alternative to traditional blockchain networks, reinforcing investor confidence and leading to a strident price increase.

Collectively, these altcoins have displayed resilient market momentum, driven by unique utility propositions and adaptive strategies to leverage the growing interest in blockchain technologies. Their respective performances not only highlight the potential of altcoins but also signal a broader acceptance and integration of innovative digital currencies into the financial ecosystem.

Top Gainers This Week

In the ever-evolving landscape of cryptocurrencies, altcoins have recently taken center stage as the value of the overall crypto economy surged to an impressive $3.29 trillion. Among the standout performers this week are notable altcoins such as Dogecoin (DOG), XRP, and Curve DAO (CRV), each recording substantial percentage gains that have drawn the attention of investors and enthusiasts alike.

Leading the pack is Dogecoin (DOG), which has experienced a remarkable rally, primarily driven by increased community engagement and an influx of social media momentum. Originally created as a meme coin, Dogecoin has transformed into a significant player within the crypto market, buoyed by passionate supporters and high-profile endorsements. As market participants continue to show interest in novel and charismatic altcoins, Dogecoin’s performance illustrates the influence of community sentiment on cryptocurrency valuations.

XRP, another prominent altcoin, has also marked impressive gains this week. Recent developments related to Ripple’s ongoing legal battles have created a more optimistic outlook among investors, as many anticipate positive resolutions. This optimism, coupled with strategic partnerships and technological advancements within the blockchain ecosystem, has propelled XRP’s price upward. As one of the leading altcoins, XRP demonstrates the critical role of regulatory clarity and market sentiment in determining price movements.

Additionally, Curve DAO (CRV) has seen a significant uptick in value, driven by the expanding interest in decentralized finance (DeFi) solutions. With the growing popularity of liquidity pools and yield farming, Curve’s decentralized exchange has gained traction, enabling it to attract a broader user base and increasing its overall market capitalization. The rise of DeFi projects underscores the potential for altcoins to benefit from innovations within the blockchain sphere that resonate with the investor community.

As the cryptocurrency market continues to evolve, the performance of these altcoins illustrates the dynamic interplay between community engagement, regulatory developments, and adherence to innovative technologies. These factors collectively contribute to the ongoing growth and potential of altcoins such as Dogecoin, XRP, and Curve DAO in the expanding crypto market.

Trading Volume Highlights

The trading volume within the cryptocurrency market serves as a critical indicator of its health and investor sentiment. Recent data shows significant activity in altcoins such as Stellar (XLM), Cardano (ADA), and Ripple (XRP), among others, contributing to the overall market capitalization that has surged to an impressive $3.29 trillion. These altcoins have not only gained traction but also reflect a broader trend toward diversification within cryptocurrency investments.

Stellar (XLM), known for its role in facilitating cross-border transactions, has seen a noticeable uptick in trading volume. This increase is partially attributed to growing institutional interest and its potential use cases within blockchain technology. Similarly, Cardano (ADA) has managed to capture investor attention, particularly after the launch of a series of smart contracts that aim to enhance its functionalities. The rising trading volume of ADA showcases a robust investor confidence that is contributing to its positive momentum amidst a thriving crypto economy.

Furthermore, XRP remains a significant player in the altcoin arena, bolstered by its ongoing partnerships with traditional financial institutions. The trading dynamics surrounding XRP suggest a resilient investor base that continues to engage with its unique value propositions, particularly concerning transaction speed and cost-effectiveness. Meanwhile, the increasing popularity of Dogecoin (DOGE) and Solana (SOL) cannot be overlooked, as both have contributed to the vibrant trading atmosphere on various exchanges.

In analyzing these trends, it becomes evident that trading volume is a canvas upon which the broader investor behavior can be painted. Altcoins like XLM, XRP, and ADA are not only changing hands frequently but also influencing market sentiment significantly. This vibrant trading behavior signals a robust interest in alternative cryptocurrencies as investors diversify their portfolios and explore the potential these digital assets offer. The landscape appears promising, suggesting that altcoins will continue to play a pivotal role in the crypto market’s evolution.

The Shadow of Underperforming Tokens

As the overall crypto economy surges past the $3.29 trillion mark, not all altcoins have shared in this upward momentum. Noteworthy among the underperformers are tokens like Moodeng and ACT, which have faced significant declines in value over the recent week. This downturn raises questions about the varying performance levels within the altcoin segment of the blockchain ecosystem, illustrating that while some cryptocurrencies rise sharply, others may struggle to maintain their market positions.

One of the primary factors contributing to the underperformance of these tokens is a lack of significant development updates or community engagement. For instance, Moodeng has experienced stagnation in its project initiatives, failing to capture the interest of investors. Similarly, ACT has seen diminishing trading volumes, which often leads to decreased visibility in the crowded market of altcoins. Without ongoing innovation or enthusiasm around their projects, these cryptocurrencies may fall prey to investor apathy, resulting in declining prices.

Market sentiment also plays a crucial role in the performance of altcoins. A sharp focus on more prominent tokens such as XLM, XRP, and ADA has overshadowed smaller or lesser-known altcoins, causing them to lose traction. Investors tend to gravitate towards those projects that promise quicker returns, often sidelining underperforming tokens. Additionally, any negative news or mining issues can exacerbate the situation, further contributing to price drops. The interconnectedness of the blockchain sector means that developments in one sector can influence the entire ecosystem, including less popular altcoins.

Ultimately, while the crypto market showcases immense potential with several thriving altcoins, the challenges faced by tokens like Moodeng and ACT serve as a reminder that not all investments yield positive results. Market dynamics are ever-changing, and while this week has seen some coins underperform, the landscape remains fluid, offering potential for recovery or further decline in the future.

Market Sentiment and Investor Confidence

As the cryptocurrency market experiences unprecedented growth, reaching a staggering $3.29 trillion, the sentiment among investors has significantly shifted. Altcoins, including notable examples such as XLM, ADA, and XRP, are steering this frenzy, with many investors diversifying their portfolios beyond Bitcoin. The market’s ambiance is characterized by optimism as Bitcoin edges closer to the pivotal psychological threshold of $100,000. This impending value milestone has sparked excitement and speculative trading behaviors among investors, who are increasingly looking at altcoins as viable alternatives for investment.

The rising confidence in altcoins is further propelled by advancements in blockchain technology, which underpins their operations. Notably, XLM and ADA have shown considerable promise in the realm of decentralized finance (DeFi) and digital transactions. Investors are also drawn to the real-world applications and formidable partnerships these altcoins have cultivated, enhancing their long-term viability in an evolving market landscape. This sentiment is reflected in the trading volumes and price surges seen across various altcoins, indicating that investors are not solely reliant on Bitcoin for their portfolio strategies.

Moreover, social media platforms and forums dedicated to cryptocurrency discussions have played a pivotal role in shaping market perception. The rapid dissemination of information, coupled with community-driven initiatives around altcoins, has fostered a culture of collective investment confidence. This growing interest in altcoins illustrates a broader trend where investors are shifting their focus from traditional financial systems to innovative digital assets. Keeping an eye on market sentiment is crucial, as it could influence future investment strategies and reshape how individuals perceive opportunities within the cryptocurrency domain.

Risks and Challenges in the Crypto Space

The cryptocurrency market, while presenting substantial opportunities for growth and investment, is fraught with significant risks and challenges that investors must carefully navigate. One of the most notable characteristics of altcoins, including well-known cryptocurrencies like XLM, ADA, and XRP, is their notorious volatility. Prices of these digital currencies can fluctuate dramatically within a short period, driven by sentiment, market trends, and external events. This inherent volatility can lead to substantial gains but equally substantial losses, making risk management a crucial component of any investment strategy in the blockchain space.

Regulatory considerations also pose a significant challenge for investors in altcoins. The cryptocurrency landscape is still evolving, and governments around the world are continuously formulating policies that may directly impact the operations of blockchain projects and the trading of digital assets. There is a growing concern regarding how these regulations might affect the legality and usability of certain altcoins. Changes in regulatory frameworks can create uncertainty, leading to swift reactions in the market, which in turn can affect prices and investor sentiment.

Moreover, market fluctuations are a constant feature of the crypto economy. Factors such as technological advancements, changes in investor demographics, and general market trends can significantly impact the performance of altcoins. Investors must remain vigilant and informed about market dynamics that could affect their holdings, as the rise of assets like Stellar (XLM), Cardano (ADA), and Ripple (XRP) can be equally tempered by sudden market downturns or adverse news events. Such fluctuations can not only affect individual investments but also shape the overall perception of cryptocurrencies in the eyes of potential investors and the broader public.

The Future Outlook for Cryptocurrencies

The cryptocurrency market has experienced remarkable growth, with the total market capitalization recently reaching $3.29 trillion. This surge has reignited discussions about the potential and sustainability of cryptocurrencies, particularly in relation to both major players and altcoins such as XLM, ADA, and XRP. As we move forward, understanding the dynamics of this rapidly evolving financial landscape becomes essential for investors and market analysts alike.

Predictions regarding the future trajectory of cryptocurrencies suggest a dichotomy developing between major currencies, such as Bitcoin and Ethereum, and increasingly popular altcoins. The rise of altcoins could indicate a diversification of investor interest, as projects like Stellar (XLM) showcase unique technological advancements and use cases. In contrast, traditional cryptocurrencies like XRP and ADA are constantly adapting to regulatory challenges and market demands, potentially influencing their price stability and growth prospects.

Moreover, as blockchain technology continues to mature, its applications in various sectors will likely expand, catalyzing further investment interest. As institutional participation grows, the overall sentiment around altcoins could experience positive momentum, contingent upon their ability to provide distinct value propositions. Investors should monitor upcoming technological developments and partnerships related to altcoins, since these factors can provide insights into which currencies are more likely to thrive in the long term.

Alongside technological advancements, regulatory developments represent a significant variable that can influence market conditions. Governments worldwide are increasingly scrutinizing digital currencies, which may dictate the operational frameworks within which altcoins must navigate. Keeping abreast of these developments is crucial for investors, as regulatory clarity can either support or hinder the growth of many emerging cryptocurrencies.

In conclusion, the future outlook for cryptocurrencies is multifaceted, marked by the interplay between major currencies and altcoins, technological advancements, and regulatory environments. By staying informed and responsive to these elements, investors can better position themselves in this dynamic landscape. Emerging trends and the performance of specific currencies will likely shape the coming months in the ever-evolving cryptocurrency sphere.

Conclusion

As the cryptocurrency market continues to evolve, reaching a significant milestone of $3.29 trillion, altcoins such as XLM, ADA, and XRP have emerged as pivotal players in this dynamic landscape. The excitement surrounding these digital currencies reflects not only their individual performance but also the broader acceptance and integration of blockchain technology across various sectors. Investors are increasingly recognizing the potential of altcoins, which offer innovative solutions and functionalities that can complement or enhance existing financial systems.

However, it is essential to acknowledge the dual nature of this burgeoning market. While the rise of altcoins presents numerous opportunities for growth and diversification, it also comes with inherent risks. Market volatility is a prominent feature of the cryptocurrency environment, where rapid price fluctuations can lead to significant financial consequences. Thus, it remains crucial for investors to conduct thorough research and remain vigilant as they navigate their cryptocurrency investments.

To harness the benefits of altcoins effectively, investors should stay informed about ongoing market trends and developments. Monitoring the performance of coins like XLM, ADA, and XRP, alongside emerging alternatives, can provide valuable insights into potential investment strategies. Furthermore, understanding the implications of technological advancements within the blockchain space will enhance decision-making capabilities in this fast-paced environment.

Ultimately, the cryptocurrency market thrives on innovation and adaptability. As new altcoins continue to enter the space, the competition and collaboration among them will shape the future of digital currencies. By maintaining an informed perspective and being prepared to adapt to changes, investors can strategically position themselves within this exciting financial ecosystem.