Introduction

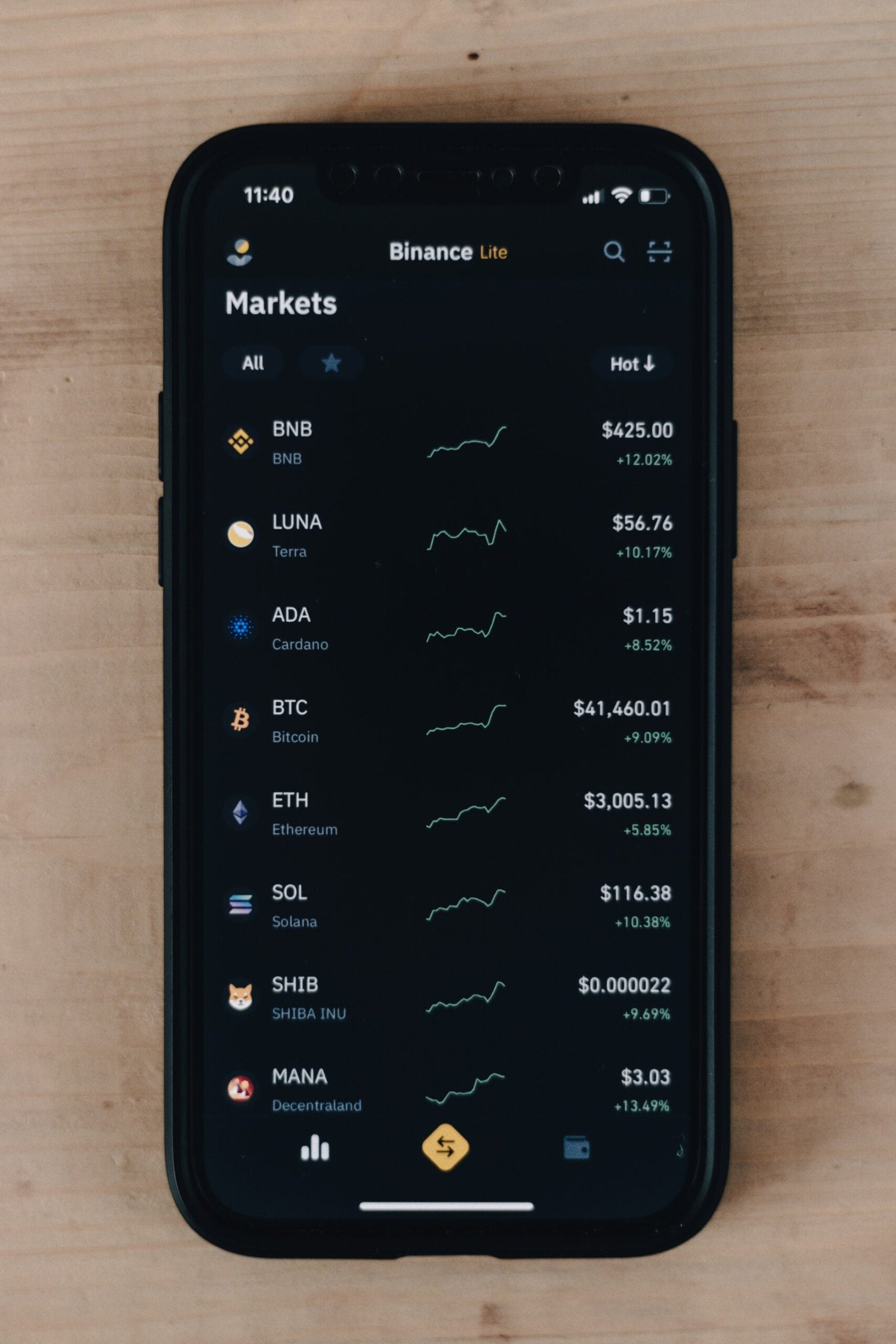

In recent weeks, the cryptocurrency market has witnessed considerable volatility, with Bitcoin (BTC) making headlines as it soared to the significant milestone of $100,000. This surge has had a profound impact on the broader market landscape, particularly for alternative cryptocurrencies such as XRP, the native digital asset of the Ripple network. As BTC ascended, XRP faced a dramatic downturn, experiencing a staggering 25% crash in its price. This situation raises pertinent questions about Ripple’s performance and the sustainability of its previous bullish rally.

The price movements of XRP in correlation with Bitcoin’s gains reflect the intricate dynamics that govern the cryptocurrency market. Historically, Bitcoin has often been viewed as a bellwether for other cryptocurrencies, with its price fluctuations influencing investor sentiment across the board. As investors accumulate gains from BTC’s impressive rally, many have begun reallocating their assets, which may inadvertently contribute to the decline observed in Ripple’s valuation.

This stark contrast between the performances of BTC and XRP invites a critical analysis regarding Ripple’s market position. While Ripple has made significant strides in establishing partnerships and enhancing its technological offerings, the recent price drop prompts investors to consider whether the bullish momentum for XRP has reached its peak. Additionally, the sentiment of the market plays a crucial role in shaping the trajectory of Ripple’s price, as investor confidence can sway dramatically based on the prevailing trends set by Bitcoin and other major cryptocurrencies.

As we delve deeper into the implications of these price movements, it becomes essential to assess whether the current downturn in Ripple’s value signals the conclusion of its rally or if it presents a strategic buying opportunity for investors.

XRP’s Dramatic Price Drop

In recent trading sessions, XRP experienced a startling price decline of 25%, igniting significant discussions within the cryptocurrency community. Prior to this precipitous drop, XRP had been demonstrating notable bullish momentum, capturing the attention of both retail and institutional investors. During this upward trend, its value surged, leading many to believe that an extended rally was on the horizon. However, the situation shifted dramatically when Bitcoin surpassed the $100K threshold, generating a wave of excitement and optimism within the broader market.

The timing of XRP’s drop raises important questions about the overall health of the Ripple ecosystem. Many investors may have anticipated that XRP would continue to gain traction alongside Bitcoin. Yet, the 25% decrease indicates a potential disconnect between investor expectations and market realities. This clash of sentiments can be attributed to several factors, including profit-taking by investors who had enjoyed substantial gains in previous weeks.

Market reactions to XRP’s price drop were swift, with a noticeable increase in selling pressure as traders sought to mitigate losses. The sentiment shifted as fear crept into the market, prompting a ripple effect of negative reactions across other altcoins. Some analysts argue that XRP’s decline may also be linked to broader regulatory concerns surrounding Ripple and its ongoing legal challenges, which continue to weigh on investor confidence.

In the context of Bitcoin’s remarkable performance, XRP’s sharp price correction highlights the volatility inherent in the cryptocurrency market. The enthusiasm surrounding Bitcoin, often seen as a barometer for the entire crypto space, created a backdrop that could have amplified investor reactions to XRP’s challenges. Clearly, market sentiment can change rapidly, and XRP must navigate this tumultuous landscape to regain its previous momentum.

Technical Analysis: XRP’s Price Movements

The recent developments in the cryptocurrency market have led to notable fluctuations in XRP’s price, especially in light of Bitcoin reaching the significant threshold of $100,000. Technical analysis of the XRP price chart reveals crucial patterns that could help investors gauge potential future movements. One of the widely observed formations is the hammer candlestick, characterized by a long lower shadow and a small body at the top, signaling a potential reversal following a downtrend. This indicates that buyers are stepping in at lower prices, which could create a floor for XRP if this bullish sentiment gains traction.

Additionally, the doji formation has been prevalent on the XRP price chart. A doji appears when the opening and closing prices are nearly identical, illustrating market indecision and a potential price consolidation phase. This pattern is significant as it reflects the uncertainty among traders regarding the direction of XRP in the short term. If a doji appears after a strong price movement, it often suggests that the preceding trend may lose momentum, paving the way for either a continuation or a reversal.

Investors must closely observe the volume accompanying these patterns. Increased trading volume during the formation of a hammer could substantiate the bullish reversal signal, whereas a doji with low volume may reinforce the indecision among traders. Furthermore, moving averages can act as critical support levels — should XRP break below these indicators, it could trigger further selling pressure, while a rebound above critical price points may restore confidence in Ripple’s potential for a short-term rally. Technical analysis, therefore, plays an integral role in understanding XRP’s current performance and making informed decisions in response to shifting market dynamics.

Key Resistance and Support Levels

Understanding key resistance and support levels is essential for any investor trading in assets like Ripple (XRP). Currently, a significant resistance level for XRP is identified at $2.1793. This level has proven to be a formidable barrier for prices attempting to rise. Whenever XRP has approached this threshold, selling pressure has often increased, resulting in rapid price corrections. Therefore, breaking through this resistance could signal a shift in market sentiment and potentially pave the way for another upward trend, indicating a renewed bullish interest in Ripple.

On the support side, the $2.17 level serves as a crucial psychological and technical support for XRP. When the price of Ripple dips to this area, it tends to attract buyers who perceive it as an advantageous entry point. However, if XRP fails to hold above this level and instead breaks below it, the implications could be significant. Such a breakdown may trigger further selling, leading traders to reassess their positions, possibly resulting in a sharper decline in price. In the context of Fibonacci retracement levels, these support and resistance levels can offer insights into potential reversal points and price targets.

Traders often employ various technical analysis tools, including Fibonacci retracements, which can assist in predicting future price movements. The Fibonacci levels can highlight potential retracement zones, making it crucial for XRP traders to keep a close eye on both the resistance at $2.1793 and the support at $2.17. The interactions at these levels will likely dictate the trading momentum of Ripple in the near future, influencing overall market dynamics. Understanding these key levels can enable traders to make more informed decisions in the volatile cryptocurrency market.

Expert Predictions on XRP Price Movements

The price movements of XRP, Ripple’s native cryptocurrency, are closely monitored by analysts and investors alike, especially given the recent fluctuations in the broader cryptocurrency market. Experts have noted that the 25% drop in XRP’s value, coinciding with Bitcoin’s surge to $100,000, raises questions about the sustainability of a bull rally for Ripple. Analysts are divided in their predictions, with some suggesting that XRP could experience a rebound while others are more cautious, anticipating further declines.

Many analysts believe that XRP might have the potential to recover and reach previously established highs. The sentiment among these experts hinges on the foundational strength of Ripple as a company, its increasing partnerships with traditional financial institutions, and its utility in cross-border transactions. Some project a target price of around $1.50 to $2.00, contingent upon a favorable market environment and further adoption of the technology that underpins ripples. Moreover, positive regulatory developments could act as catalysts for higher prices.

In conclusion, while predictions for XRP’s future price movements vary greatly, it is evident that both bullish and bearish scenarios exist. Continuous monitoring of market conditions and regulatory developments will be imperative for stakeholders looking to navigate the uncertain waters surrounding Ripple’s price dynamics.

Implications of Bitcoin’s Price Surge on XRP

The recent surge of Bitcoin’s price crossed the significant threshold of $100,000, which has had profound implications for the overall cryptocurrency market, including Ripple’s digital asset, XRP. First and foremost, Bitcoin is often regarded as the bellwether for the entire crypto ecosystem. Its price movements typically set the market tone, meaning that fluctuations in Bitcoin can directly influence other cryptocurrencies, including Ripple.

As Bitcoin experiences a rapid ascent, investor behavior tends to shift, impacting the perceptions and strategies regarding alternative cryptocurrencies like XRP. Historically, increased volatility in Bitcoin has led to a surge in trading activity across other assets in the market. This can manifest in both buying and selling behaviors, as traders scramble to capitalize on perceived opportunities or shield themselves from potential losses. Consequently, when Bitcoin reached the pivotal $100,000 mark, it not only sparked enthusiasm among Bitcoin investors but also created an environment of uncertainty for XRP holders, leading some to evaluate their positions critically.

Moreover, the psychological effects of Bitcoin’s momentum cannot be understated. The achievement of such a milestone may prompt a sense of euphoria among investors, driving heightened interest in the crypto market overall. This newfound attention could inadvertently overshadow smaller assets such as XRP, making it difficult for Ripple to sustain its price levels amidst the Bitcoin surge. The increased focus on Bitcoin may lead to a decrease in capital flow towards XRP, which could perpetuate the recent price instability experienced by Ripple.

In conclusion, as Bitcoin’s price hits record highs, the ripple effects on alternative cryptocurrencies like XRP become apparent. Understanding these dynamics is essential for investors to navigate the complex landscape of the cryptocurrency market effectively.

Market Sentiment and Investor Reactions

The recent 25% decline in XRP’s price has sent ripples through the crypto market, amplifying diverse sentiments among investors. As Bitcoin (BTC) surge towards the $100,000 mark, a wave of optimism accompanied by uncertainty has emerged regarding Ripple’s future. In the wake of the price crash, a bullish faction remains steadfast, believing that XRP’s fundamentals and institutional backing will ultimately prevail. This group underscores the significant partnerships Ripple has forged and its ongoing efforts in providing efficient cross-border payment solutions. Many investors are optimistic about XRP’s long-term growth, viewing the current dip as a potential opportunity to accumulate more tokens at a reduced price.

Conversely, the bearish sentiment is palpable amongst investors who express concerns about market volatility, primarily influenced by Bitcoin’s historical dominance in price movements across the cryptocurrency sector. This cohort often highlights the potential risks associated with regulatory scrutiny surrounding Ripple, which could further impact XRP’s capabilities and adoption rate. Technical indicators, such as moving averages and relative strength metrics, currently paint a mixed picture, suggesting that market participants are divided in their perspectives.

Additionally, social media platforms and crypto forums are abuzz with discussions regarding the trends in trading volume, investor activities, and sentiment analysis. Traders are closely monitoring the price action of XRP to gauge potential breakouts or further declines, which may significantly influence future trading strategies. Reports indicating a surge in trading activity during price rebounds signify that investor responses might be fundamentally tied to emotions, thus accentuating the volatility of the asset. Leaders in the cryptocurrency space remind investors to exercise caution, as market dynamics can shift rapidly, thus impacting both the bullish and bearish narratives surrounding Ripple and its digital asset XRP.

Conclusion: Is the Bull Run Over?

The recent fluctuations in the cryptocurrency market have placed a spotlight on Ripple and its native digital asset, XRP. With Bitcoin (BTC) soaring past the $100,000 mark and subsequently triggering a significant sell-off across various altcoins, XRP has not been exempt from this volatility. An alarming 25% decrease in XRP’s price has prompted investors and analysts alike to reassess the prospects of a sustained upward trend. This raises pertinent questions about the longevity of Ripple’s bull run and the broader implications for the market.

Fundamentally, the future of XRP hinges on several key factors, including regulatory developments, market adoption, and technological advancements. Ripple Labs has continued to foster partnerships and innovations that bolster its use case for facilitating efficient cross-border payments. However, the heightened regulatory scrutiny in the cryptocurrency space could potentially impact Ripple’s operations and market sentiment surrounding XRP.

From a technical analysis perspective, the recent price action indicates that XRP may be facing resistance at crucial support levels, suggesting potential corrections are likely in the near term. Traders have observed that while momentum indicators exhibit signs of bullish patterns, the overall market trend is heavily influenced by Bitcoin’s performance. Thus, XRP’s fate appears intricately tied to BTC’s movements, as any adverse shifts may drive further price corrections for Ripple.

Ultimately, as the market continues to evolve, discerning whether Ripple’s bull rally is truly over will depend on a careful analysis of ongoing developments. While the current downturn prompts caution, it does not eliminate the possibility of XRP regaining momentum in the future. Active monitoring of the aforementioned factors will be essential for investors aiming to navigate this complex landscape effectively.

Future Outlook for Ripple (XRP)

The future outlook for Ripple (XRP) is subject to the dynamic nature of the cryptocurrency market, influenced by various factors including technical indicators, regulatory developments, and market trends. As of now, XRP has faced significant volatility, primarily influenced by Bitcoin’s recent price surge, which reached $100K. This sharp increase in BTC has historically led to a correlation effect on altcoins, including Ripple. However, Ripple’s unique position as a payment protocol, coupled with its focus on international remittances, provides it with a distinctive edge in the market.

From a technical standpoint, analysts are closely monitoring crucial price levels and indicators. Currently, Ripple has established key support and resistance zones, which will play a critical role in determining its price movement in the near future. A breach below the support level could signify a further decline, while a rally past resistance may reaffirm bullish sentiments among investors. Additionally, the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are being analyzed to gauge investor sentiment and potential reversal points.

Moreover, the regulatory environment surrounding Ripple and its token is continuously evolving. Developments in legal proceedings, particularly the case against the SEC, are expected to have a substantial impact on XRP’s future. A favorable ruling could bolster Ripple’s market position and attract institutional investors, while an adverse outcome could hinder its growth prospects. Furthermore, advancements in blockchain technology and partnerships with financial institutions could enhance Ripple’s adoption, making it a significant player in the digital currency space.

In conclusion, while the future of Ripple (XRP) faces uncertainties, ongoing monitoring of technical indicators, regulatory developments, and market trends will be essential for investors seeking insights into its performance. The evolving landscape will ultimately determine whether XRP can capitalize on the burgeoning cryptocurrency market or succumb to the external pressures it faces.