The Enigmatic Origins of Bitcoin

The inception of Bitcoin traces back to October 2008, a time marked by financial turmoil and growing distrust in traditional banking systems. It was during this period that an individual or group under the pseudonym Satoshi Nakamoto published the Bitcoin white paper, titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This seminal document outlined a groundbreaking decentralized digital currency designed to operate without the need for intermediaries, fundamentally challenging the existing monetary framework.

Despite the significant impact Bitcoin has had since its inception, many mysteries surround Satoshi Nakamoto’s identity. There have been countless theories regarding the true persona behind this enigmatic figure, ranging from speculations that Nakamoto is one person to ideas suggesting a collaborative effort. Some believe that Nakamoto could be a well-known figure in the tech world, while others think it may even involve government agencies interested in defining the future of money. This anonymity has sparked debates and, at times, conspiracy theories throughout the cryptocurrency community.

The implications of Nakamoto’s anonymity on the Bitcoin phenomenon cannot be overstated. By remaining an enigma, Nakamoto has fostered a sense of intrigue and trust within the Bitcoin community, creating a grassroots movement built around the principles of decentralization, transparency, and financial freedom. This very mystery surrounding the creator has helped Bitcoin to garner a dedicated following, encouraging innovative use cases and adapting to the ever-evolving financial landscape. As Bitcoin continues to impact economies around the world, the question of Nakamoto’s true identity remains a tantalizing enigma, drawing intellectual curiosity amidst the cryptocurrency’s remarkable rise.

Bitcoin and Its Dark Allegations

Bitcoin, the pioneering cryptocurrency, has gained notoriety not only for its innovative technology but also for its controversial reputation. Over the years, Bitcoin has become a financial instrument intertwined with the dark web, raising significant concerns regarding its legitimacy as a currency. The association between Bitcoin and illegal activities is particularly pronounced when examining its prevalent use in ransomware attacks. Hackers often demand ransom payments in Bitcoin, capitalizing on the cryptocurrency’s pseudonymous nature, which makes tracing transactions difficult for authorities.

The illicit trade landscape has also seen a surge in Bitcoin transactions. From drug trafficking to weapons sales, various underground activities have leveraged the anonymity provided by Bitcoin to facilitate their operations. This dark association has led to Bitcoin being frequently labeled as a tool for criminals, overshadowing its potential benefits as a legitimate medium of exchange. The ability to conduct transactions outside conventional banking systems has piqued the interest of malicious actors who exploit this advantage for illegal means.

Moreover, sensational media coverage often amplifies these negative aspects, creating a public perception that Bitcoin is synonymous with crime. While it is crucial to acknowledge these allegations, it is equally important to consider the broader context. Bitcoin has also been utilized for positive purposes, such as donations for charitable causes and as a hedge against inflation in certain economic climates. However, the shadow of its dark associations raises questions about its credibility and the challenges it faces in gaining mainstream acceptance. As the cryptocurrency continues to evolve, the interplay between its potential benefits and the tarnished image linked to its darker uses will remain a critical point of discussion.

The Fall of Cryptocurrency Icons

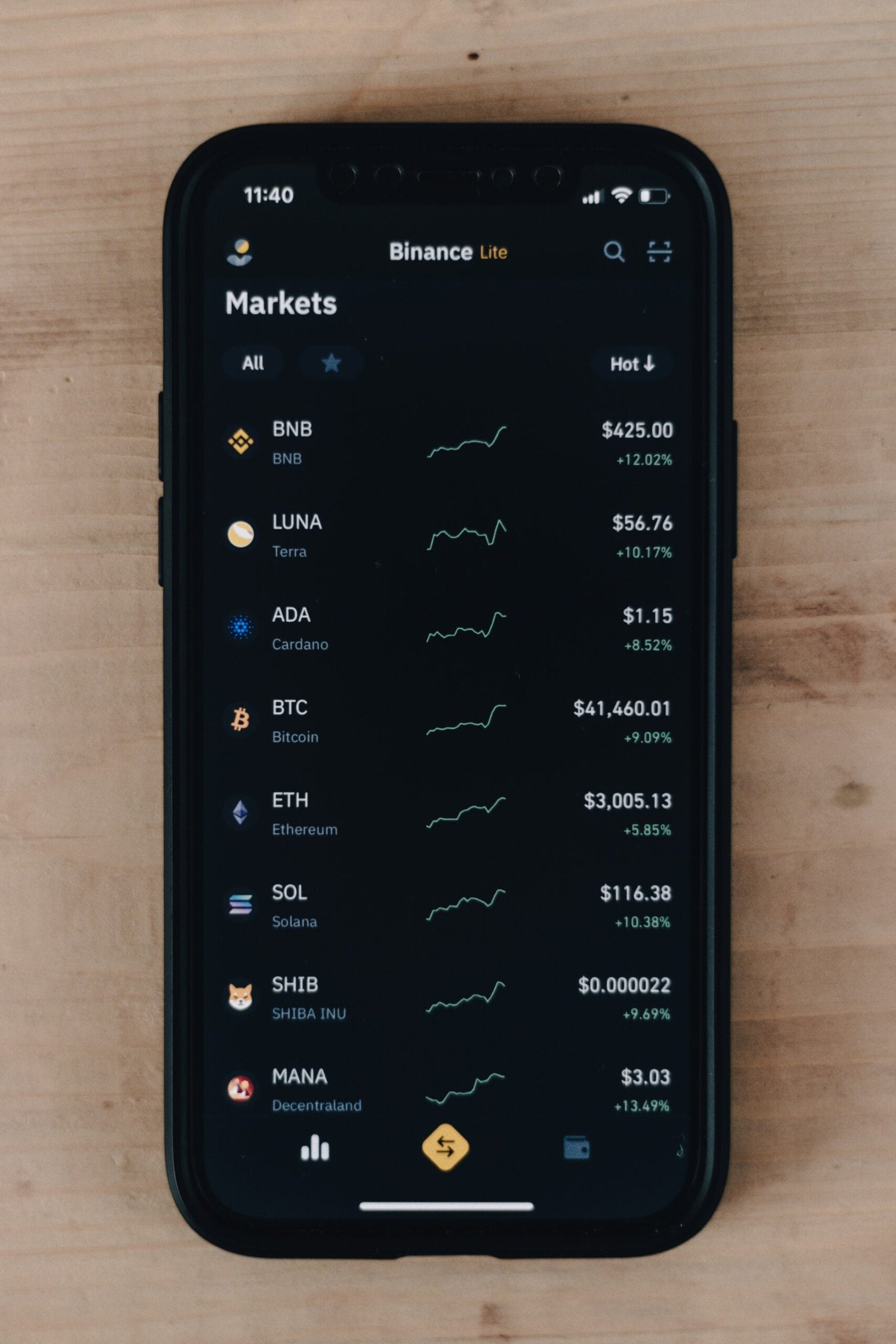

The cryptocurrency market, which has often been characterized by rapid ascents and daunting descents, has recently witnessed a series of unprecedented events that have further contributed to its volatility. High-profile bankruptcies and legal troubles involving significant figures such as Changpeng Zhao and Sam Bankman-Fried have garnered widespread attention and prompted a reevaluation of the integrity of the crypto industry. These events have generated uncertainty among investors and have raised pressing questions about the long-term viability of various cryptocurrencies, including bitcoin.

Changpeng Zhao, founder of Binance, and Sam Bankman-Fried, once hailed as a visionary in the realm of digital finance, have faced increased scrutiny in the wake of legal investigations and allegations of misconduct. The fall of such influential figures has not only affected public perception of their respective platforms but has also cast a shadow over the broader cryptocurrency ecosystem. The sensational headlines surrounding these cases have fueled skepticism regarding the governance practices and regulatory frameworks that underpin the various cryptocurrency exchanges and projects.

The ramifications of these developments are significant. Investor confidence in cryptocurrency is often closely tied to the reliability of prominent entities and personalities within the market. As the bitcoin all-time high set new records in previous years, the ramifications of these high-profile downfalls have created a stark contrast. Many investors, initially emboldened by the bullish momentum of the market, now find themselves questioning the sustainability of their investments amid news of these controversies. Public trust appears to have eroded, with some viewing cryptocurrency as a speculative endeavor rather than a legitimate financial alternative.

As the industry grapples with these challenges, stakeholders must confront a pivotal moment that may redefine the landscape of cryptocurrency. Addressing the issues surrounding governance, transparency, and accountability becomes essential to restoring faith in bitcoin and other digital assets. Failure to navigate these turbulent waters may hinder the growth and acceptance of cryptocurrency as a mainstream financial asset.

Towards Regulatory Acceptance

Recent developments within the financial landscape indicate a significant shift towards the regulatory acceptance of Bitcoin and other cryptocurrencies. The growing interest in digital assets has, in part, been influenced by notable political moves, including former President Donald Trump’s appointment of a cryptocurrency advocate to lead the Securities and Exchange Commission (SEC). This strategic decision signals a recognition of the increasing importance of cryptocurrencies in the modern economy, and showcases a willingness to create a more favorable regulatory environment for Bitcoin.

The appointment of a pro-crypto SEC chair represents a departure from previous regulatory stances, which often sought to restrict cryptocurrency innovations. As the Bitcoin ecosystem continues to mature, it has become evident that cryptocurrencies like Bitcoin are not just mere speculative investments but have the potential to integrate into mainstream finance. This understanding has driven calls for more transparent guidelines that can foster innovation while ensuring consumer protections are in place.

Additionally, the approval of Bitcoin Exchange-Traded Funds (ETFs) has further bolstered this shift towards greater legitimacy. These financial products allow investors to gain exposure to Bitcoin in a regulated manner, which significantly reduces the barriers to entry for retail investors. The positive reception of Bitcoin ETFs not only represents a pivotal moment in Bitcoin’s evolution but also enhances the narrative surrounding its acceptance and integration into traditional financial systems.

This convergence of regulatory support and the growing marketplace indicates a crucial moment for Bitcoin and its future trajectory. As both political and market developments align, the potential for Bitcoin to achieve widespread adoption appears increasingly plausible. The enhancement of public and regulatory acceptance of Bitcoin is a promising milestone, paving the way for greater innovation in the cryptocurrency sector. In conclusion, as we navigate these changes, observing how Bitcoin evolves within the framework of regulatory acceptance will be critical for investors and stakeholders alike.

El Salvador: A Case Study in Bitcoin Adoption

The decision of El Salvador to adopt Bitcoin as legal tender in September 2021 marked a significant milestone in cryptocurrency history. This move was heralded by President Nayib Bukele as a means to stimulate economic growth and increase financial inclusion for the country’s unbanked population. With an estimated 70% of adults lacking access to traditional financial services, the integration of Bitcoin aims to provide a new pathway for economic participation. As such, it reflects a bold experiment in utilizing digital currencies within a national economy.

However, the acceptance of Bitcoin among the Salvadoran populace has been met with mixed reactions. Surveys indicated that while approximately 20% of residents were enthusiastic about the prospect of using Bitcoin, a substantial portion remained skeptical. Factors contributing to this skepticism include the volatility associated with Bitcoin, highlighted by its sharp fluctuations in value. For instance, shortly after its introduction as legal tender, Bitcoin experienced significant price swings, raising concerns among citizens about the practicality of using a currency so subject to market manipulation. The Bitcoin all-time high, although promising to investors, generated anxiety among those reliant on stable economic transactions.

In response to these challenges, the government has rolled out initiatives to promote Bitcoin literacy and adoption. Programs aimed at educating the population about cryptocurrency and its management have been initiated, but the question remains whether these efforts will translate into widespread acceptance. Additionally, the reliance on Bitcoin has drawn criticism, especially in the context of further integrating such a variable currency into the fabric of national finance. The ongoing debate reflects broader discussions about the role of digital currencies like Bitcoin in shaping economic futures, especially within emerging markets that face distinct challenges. As El Salvador navigates this uncharted territory, the outcomes of its Bitcoin experiment will be instructive for other nations considering similar paths.

Understanding Blockchain Technology

At the core of Bitcoin lies a revolutionary technology known as blockchain. This decentralized ledger system enables the secure storage and transfer of information across a network of computers. Each transaction involving Bitcoin is recorded in a block, which is then linked to a previous block, creating a chain of chronological transaction data. This method enhances transparency, as every participant can trace the historical records, making manipulation significantly more difficult.

Blockchain operates on a consensus mechanism, the most common being proof-of-work. In this process, miners—individuals using powerful computers—validate and verify transactions by solving complex mathematical problems. Once verified, transactions are added to the blockchain, and miners are rewarded with newly minted Bitcoin, making mining a crucial component of the Bitcoin ecosystem. This interconnectedness between transactions, miners, and the blockchain structure fosters a self-regulating environment, inherently limiting the influence any single entity can have over the entire network.

Created by an anonymous individual or group under the pseudonym Satoshi Nakamoto, the Bitcoin protocol has strict parameters in place to control the currency’s supply. The total supply of Bitcoin is capped at 21 million coins, a limitation designed to create scarcity and, consequently, potential value appreciation over time. This deflationary model contrasts with traditional fiat currencies, which can be printed at will, thereby enabling inflation. The finite supply mechanism, combined with growing demand, reinforces why Bitcoin reached its all-time high in value and piques the interest of investors and analysts alike.

In a rapidly evolving digital landscape, understanding the nuances of blockchain technology is essential. It is not merely a support system for Bitcoin; rather, it represents a paradigm shift in how value and information can be exchanged in a secure manner. This foundational understanding captures the essence of why Bitcoin continues to thrive and dominate discussions surrounding cryptocurrency, including the influence of prominent figures like Donald Trump on public perceptions and market behavior.

The Volatility of Bitcoin: A Double-Edged Sword

Bitcoin has become synonymous with volatility, characterized by its dramatic price fluctuations that can occur within short time frames. This volatility can present opportunities for substantial gains, as seen in notable instances where Bitcoin reached its all-time high. However, it also poses significant risks, leading to the potential for substantial losses. Investors often find themselves navigating a landscape where the price can soar or plummet unexpectedly, influenced by various factors that contribute to this unpredictability.

Several key elements drive the volatility of Bitcoin. First among these is market sentiment, which can shift rapidly in response to news and events. Major announcements, regulatory changes, and influential figures, such as Trump, can sway public perception and investor behavior, resulting in sharp price movements. For example, Trump’s comments regarding cryptocurrencies in a positive or negative light can trigger swift reactions, underscoring how political climate can inject uncertainty into the market.

Another contributor to Bitcoin’s volatility is its relatively low market capitalization compared to traditional assets. This means that larger trades can disproportionately impact the cryptocurrency’s price, leading to wild swings. Additionally, the limited supply of Bitcoin, capped at 21 million coins, heightens the effect of demand dynamics. As more investors rush to acquire Bitcoin during bullish trends, the price can skyrocket, reinforcing its reputation for rapid appreciation.

Furthermore, the advent of cryptocurrency derivatives and speculative trading has intensified Bitcoin’s price volatility. Traders aiming to profit from short-term price movements often exacerbate fluctuations, creating a more unstable environment. While some investors might be drawn to the potential rewards of this volatility, others may be dissuaded by the associated risks, impacting overall market stability and investor confidence. Thus, the dual nature of Bitcoin’s volatility creates a complex landscape where both opportunities and challenges coexist.

Investing in Bitcoin: Risks and Rewards

The allure of investing in Bitcoin stems from its potential for substantial returns, particularly when considering its remarkable price fluctuations. Over the years, Bitcoin has reached significant milestones, including peaks that have been labeled as its all-time high. This volatility often attracts both seasoned investors and newcomers to the cryptocurrency market, each eager to capitalize on price surges. However, alongside the prospects for profit, there are inherent risks that cannot be overlooked. The unpredictable nature of Bitcoin can yield rapid gains, but equally, it can lead to significant losses, particularly during downturns.

Investment strategies in Bitcoin vary widely. Some investors adopt a long-term “HODL” approach, holding onto their bitcoins regardless of market fluctuations, betting on its future value appreciation. Others engage in short-term trading, attempting to exploit market movements for profit. Each strategy requires a different risk tolerance and level of market understanding. Being aware of market trends and employing sound investment principles are vital to navigating the cryptocurrency landscape successfully. Moreover, investors should remain informed about the evolving regulations surrounding cryptocurrency, as these can dramatically influence market behavior and investor sentiment.

Regulatory developments play a critical role in shaping the investment landscape for Bitcoin. Changes in government policy can have immediate effects on the market, as seen when statements from influential figures, including politicians like Donald Trump, influence public perception and regulatory scrutiny. As Bitcoin continues to grow in popularity and legitimacy, understanding the implications of such external factors becomes essential for any investor. With ongoing debates regarding the appropriate regulatory framework for cryptocurrencies, it is crucial for investors to remain vigilant and adaptable. Striking a balance between recognizing the potential rewards and being mindful of the accompanying risks will ultimately determine the success of any investment in Bitcoin.

The Future of Bitcoin in a Changing Landscape

The trajectory of Bitcoin, once seen merely as a speculative asset, is under increasing scrutiny as regulatory frameworks, technological advancements, and shifts in public perception evolve. Recent developments showcase a growing interest among regulators worldwide to establish comprehensive guidelines aimed at integrating Bitcoin into the mainstream financial ecosystem. Governments are beginning to realize the potential economic benefits associated with cryptocurrencies, and Bitcoin, as the foremost digital currency, stands to gain significantly from this attention.

Innovations in technology also play a crucial role in reshaping the future landscape of Bitcoin. For instance, initiatives enhancing transaction speed and security propose to address some of the previous criticisms regarding Bitcoin’s scalability and transaction costs. The implementation of layer-two solutions, such as the Lightning Network, aims to facilitate more efficient transactions, thereby improving the overall viability of Bitcoin for everyday use. Such advancements indicate a trend toward Bitcoin not just being a store of value, but also a practical medium of exchange.

Moreover, public perception of Bitcoin is shifting as institutions increasingly adopt it as an asset class. Major corporations and investment funds have begun to allocate resources to Bitcoin, further legitimizing it within traditional finance. This transition is evidenced by the interest from high-profile investors and notable endorsements, such as former President Trump’s commentary on digital currencies. His influence on public opinion highlights the importance of leadership in shaping attitudes toward Bitcoin and could even impact its price trajectory during times of volatility.

As Bitcoin continues to navigate its place within a changing regulatory and technological environment, its potential to evolve from a speculative asset to a mainstream financial option seems plausible. However, the journey ahead remains fraught with challenges that will undoubtedly test its resilience and adaptability.