Introduction to Bitcoin and Central Bank Reserves

Central banks play a critical role in maintaining the stability of a country’s economy, often utilizing reserve assets to support their financial systems. Reserve assets are generally held to ensure that the central bank has the ability to manage its monetary policy effectively. These assets typically include foreign currency reserves, gold, and government securities. However, in recent years, the emergence of cryptocurrencies, particularly Bitcoin (BTC) and its underlying technology, blockchain, has sparked discussions regarding their potential as reserve assets.

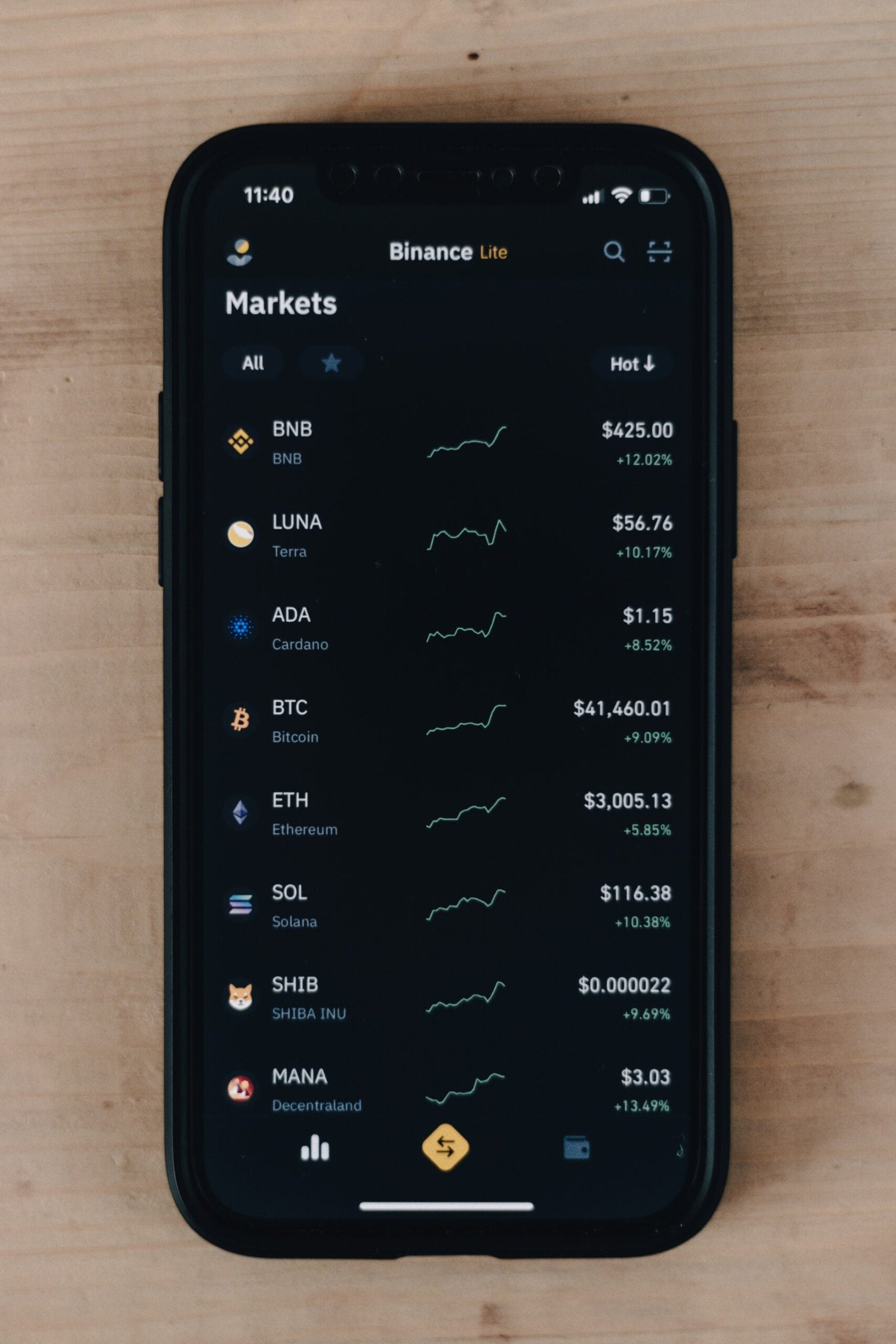

Bitcoin, a decentralized digital currency that operates without a central authority, has gained significant attention from institutions and investors alike. Its limited supply and ability to function as a store of value have led some to consider it as an alternative to traditional reserve assets. The growing interest in Bitcoin is fueled by its potential to provide a hedge against inflation and currency devaluation, aspects that are particularly pertinent to central banks managing their reserve portfolios.

As central banks explore diverse asset classes to enhance their reserves, the concept of Bitcoin as a reserve asset is becoming increasingly relevant. However, the volatility associated with cryptocurrencies poses concerns for central banks that prioritize stability and risk management. The Central Bank of Chile has recently taken a definitive stance against incorporating Bitcoin into its reserve framework, citing traditional principles of reserve asset management. This decision reflects a cautious approach, balancing innovation with the necessity of maintaining economic stability.

In light of this, understanding the dynamics between central bank reserves and cryptocurrencies like Bitcoin is crucial. There is an ongoing debate among economists, policymakers, and financial experts regarding the viability of including digital currencies in reserve strategies. The Central Bank of Chile’s decision serves as a focal point in this discussion, prompting further exploration of the implications of Bitcoin in the context of national monetary systems.

Recent Statement from the Central Bank of Chile

In a recent announcement, the Central Bank of Chile made a definitive statement rejecting Bitcoin as a reserve asset. This decision reflects a cautious stance on the inclusion of cryptocurrency within the nation’s financial framework. The bank articulated that Bitcoin does not meet the established criteria necessary for an effective reserve asset. According to the bank, “digital currencies lack the requisite stability and liquidity demanded by reserve objectives.” This assertion underlines a broader skepticism prevalent among central banks regarding the adoption of cryptocurrencies such as Bitcoin for reserve purposes.

The rationale behind this decision emanates from concerns surrounding the inherent volatility associated with cryptocurrencies. Unlike traditional assets like foreign currencies or gold, Bitcoin has exhibited significant price fluctuations over short periods, raising issues regarding its reliability as a reserve. Additionally, the Central Bank of Chile indicated that the lack of a centralized authority overseeing Bitcoin and its transactions complicates the asset’s potential candidacy as a reserve. This decentralized nature is at odds with the existing regulatory frameworks that govern conventional bank reserves.

Furthermore, the Central Bank has highlighted that cryptocurrencies, in their current form, do not conform to the necessary liquidity standards expected of reserve assets. As stated in their report, reserve assets are intended to serve specific functions, including stability during economic turbulence and facilitation of international transactions. Bitcoin, while being a prominent cryptocurrency, fails to align with these objectives due to its unpredictable market behavior.

Ultimately, the Central Bank of Chile’s rejection of Bitcoin as a reserve asset exemplifies the ongoing debate among financial institutions globally regarding the viability of cryptocurrencies. The stance taken reflects a conservative approach rooted in maintaining economic stability rather than adopting unproven digital assets.

Criteria for Reserve Assets Explained

The International Monetary Fund (IMF) outlines specific criteria that assets must meet to be classified as reserve assets. These criteria primarily include security, liquidity, and overall quality. Understanding these elements is essential for central banks as they evaluate potential reserve assets, influencing their decisions regarding the inclusion of cryptocurrency, such as Bitcoin (BTC), in their portfolios.

Security is the first criterion and refers to the assurance that an asset will retain its value over time. Traditional reserve assets, such as gold or government bonds, have established track records of stability. Conversely, Bitcoin and other cryptocurrencies are known for their high volatility. This unpredictability poses a significant risk for central banks that require stability to safeguard their reserves against inflation and other economic pressures. Therefore, Bitcoin’s fluctuating prices do not align with the security requirement.

Liquidity is another crucial factor. An asset is deemed liquid if it can be easily bought or sold in the market without significantly affecting its price. Traditional reserve assets exhibit high liquidity, meaning they can be quickly converted into cash or a stable currency. In contrast, Bitcoin may face liquidity challenges, particularly in less mature markets. While the cryptocurrency market has grown, it is still characterized by inconsistent trading volumes, which could affect a central bank’s ability to liquidate assets promptly when necessary.

The overall quality of a reserve asset encompasses factors like creditworthiness and risk. Established currencies are supported by strong and stable governments, contributing to their perceived quality. Bitcoin, being decentralized and not backed by a sovereign entity, raises questions about its overall reliability as a reserve asset. Thus, central banks remain cautious when considering cryptocurrencies for their reserves, ultimately aligning with the IMF’s standards for reserve assets.

Legal Restrictions on Asset Inclusion

The Central Bank of Chile operates within a defined legal framework that dictates the types of assets deemed permissible for inclusion in its reserves. This framework is influenced by the nation’s financial policies, regulatory structures, and objectives aimed at maintaining economic stability. Currently, the laws and guidelines emphasize the management of traditional assets such as gold, government bonds, and foreign currencies. These restrictions create an operational environment where non-traditional assets like bitcoin (BTC) and other cryptocurrencies face significant barriers to entry.

One of the primary regulations governing asset inclusion is the Ley Orgánica del Banco Central de Chile, which outlines the functions and scope of the central bank. This legislation focuses on traditional monetary assets, precluding the Central Bank from exploring innovative asset classes such as blockchain-based currencies. The potential volatility and lack of regulation surrounding cryptocurrencies deem them unsuitable for reserve holdings according to these existing legal frameworks. As a result, the bank avoids adopting assets that might jeopardize its ability to manage the national currency and uphold financial stability.

Additionally, the Chilean financial regulatory authorities have established specific guidelines aimed at enhancing banking and financial system integrity. These criteria require governance standards that established cryptocurrencies currently do not satisfy, primarily due to their decentralized nature and the associated risks. The unpredictability of digital currencies further complicates their integration into official reserves, as central banks prioritize security, liquidity, and predictability in asset management. In summation, the legal restrictions imposed by the Central Bank of Chile emphasize the importance of traditional assets and limit the inclusion of cryptocurrencies, thereby reinforcing the central bank’s commitment to maintaining a stable financial ecosystem.

Comparative Analysis: Brazil’s Strategic Bitcoin Reserve Proposal

In recent months, Brazil has positioned itself as a forward-thinking nation regarding cryptocurrency adoption, particularly with its initiative to propose a strategic Bitcoin reserve. This approach stands in stark contrast to Chile’s recent decision to reject Bitcoin as a reserve asset, demonstrating differing regulatory perspectives in South America. Brazil’s proposal aims to leverage the benefits of blockchain technology and the decentralized nature of Bitcoin to enhance national financial stability and economic growth.

The strategic Bitcoin reserve bill suggested by Brazilian lawmakers is designed to stabilize the national economy by using cryptocurrency as a hedge against inflation and economic uncertainties. By establishing a framework for Bitcoin reserves, Brazil seeks to embrace innovation and tap into the growing cryptocurrency market, potentially inviting foreign investment and fostering a more dynamic economic environment. This proactive stance reflects a broader acceptance of blockchain technology, addressing both its opportunities and risks.

Conversely, Chile’s recent stance against Bitcoin highlights a more cautious approach to cryptocurrency regulation. The Chilean government has expressed concerns over the potential risks associated with adopting Bitcoin as a reserve asset, particularly regarding stability, security, and the overall volatility associated with this cryptocurrency. The rejection of Bitcoin as a reserve may limit Chile’s ability to fully explore the benefits of blockchain technology and the rapid advancements occurring within the cryptocurrency market.

This divergence in regulatory approaches between Brazil and Chile may have wider implications for the region. As Brazil moves forward with its Bitcoin reserve proposal, it could serve as a model for other Latin American countries, promoting a shift towards a more crypto-friendly regulatory environment. Meanwhile, Chile’s conservative approach may risk its competitiveness in the evolving global market. The outcome of these initiatives may significantly affect how other nations in the region perceive cryptocurrency and its role in modern finance.

The Debate on Bitcoin’s Viability as a Reserve Asset

The ongoing debate surrounding the viability of Bitcoin and other cryptocurrencies as reserve assets is multifaceted, involving a range of perspectives from economists, policymakers, and financial analysts. One of the primary discussions centers around the inherent volatility of Bitcoin. For instance, while proponents argue that its decentralized nature and limited supply make it a substantial store of value, critics point to its significant price fluctuations as a barrier to stability. This volatility raises questions about the feasibility of integrating bitcoin into central banking frameworks, where consistency and predictability are paramount.

From a policy perspective, central banks are traditionally tasked with maintaining monetary stability, which includes managing inflation and ensuring confidence in the national currency. Following the Central Bank of Chile’s recent rejection of bitcoin as a reserve asset, it’s clear that regulatory bodies are cautious regarding the incorporation of cryptocurrencies into their reserve strategies. The fear of undermining their monetary policies is very real, especially considering the potential for cryptocurrencies to operate outside of conventional financial systems. Some economists posit that adopting bitcoin could lead to increased dollarization of economies, thereby weakening local currencies further.

Furthermore, the implications of endorsing bitcoin as a reserve asset extend beyond financial markets; they touch on issues of sovereignty and regulatory control. If governments are unable to oversee transactions entirely due to the decentralized nature of blockchain technology, they may find it challenging to implement effective monetary policies. Consequently, this debate raises fundamental questions about the relationship between traditional banking systems and the emerging cryptocurrency landscape. Financial analysts emphasize that as the cryptocurrency market evolves, policymakers must carefully consider the potential risks and benefits of integrating assets like bitcoin into national reserve strategies.

Impacts of Not Including Bitcoin

The recent decision by the Central Bank of Chile to exclude Bitcoin from its reserves may have significant ramifications for the country’s financial landscape. Without the integration of cryptocurrency like Bitcoin, Chile risks missing out on the burgeoning financial ecosystem that cryptocurrencies offer. In today’s rapidly evolving financial markets, cryptocurrencies are increasingly viewed as viable alternatives to traditional banking assets. By not embracing Bitcoin, Chile’s financial institutions may find themselves at a disadvantage compared to their international counterparts that have diversified reserve portfolios to include cryptocurrency.

One of the primary concerns arising from this decision is its potential impact on Chile’s financial stability. The exclusion of Bitcoin may lead to a lack of diversification in the country’s monetary reserves. In situations of economic downturn or market volatility, Bitcoin has, at times, proven to be a performance hedge. By dismissing this asset class, the Central Bank of Chile might be limiting its options to stabilize the economy and manage risks associated with fluctuations in global markets.

Moreover, the decision may influence Chile’s standing in the international financial community. Many countries are actively exploring the inclusion of cryptocurrencies into their financial frameworks. A failure to adapt to this trend could position Chile as a laggard in the global financial arena, potentially deterring foreign investment and reducing opportunities to engage in international trade. Investors are keenly observing how countries are integrating Bitcoin within their financial strategies, and a rejection may alter their perception of Chile as a stable and progressive market.

In addition to financial considerations, investor sentiment can also be adversely affected. The growing popularity of Bitcoin and other cryptocurrencies among retail and institutional investors signifies a shift towards alternative assets as means of wealth preservation. A central bank that does not recognize these shifts may send a cautionary signal, making investors hesitant to engage with Chilean financial products or ventures.

Future of Cryptocurrency in Central Banking

The decision by the Central Bank of Chile to reject Bitcoin as a reserve asset raises significant questions about the future of cryptocurrencies within central banking frameworks globally. As governments and financial authorities scrutinize the rise of digital currencies, varied responses are emerging. While Chile has firmly positioned itself against adopting BTC as part of its monetary reserves, other central banks may approach the matter with more flexibility, particularly in light of the evolving landscape of digital assets.

Several nation-states have begun exploring central bank digital currencies (CBDCs), which are government-backed digital currencies distinct from cryptocurrencies like Bitcoin. These initiatives reflect an acknowledgment of the growing role that blockchain technology and digital currencies play in today’s financial ecosystem. Countries like China are already piloting their digital yuan, demonstrating a strategic embrace of blockchain to enhance transaction efficiency and modernize financial infrastructures.

Currencies such as Bitcoin pose challenges to traditional banking systems, prompting central banks to reconsider their policies. The volatility associated with cryptocurrencies and regulatory concerns regarding their use for illicit activities have made some institutions cautious. However, the increasing acceptance and adoption of crypto assets among consumers and investors cannot be overlooked; this trend may compel more central banks to integrate cryptocurrencies into their frameworks in the future.

As they grapple with the potential implications and benefits of Bitcoin and other digital currencies, central banks may find themselves at a crossroads. The balance between innovation and regulation will be crucial. Factors such as public interest, technological advancements, and international cooperation will likely influence whether we see more central banks echo Chile’s stance or embrace the integration of cryptocurrencies. The evolution of monetary systems may very well hinge on how these institutions navigate the complex landscape of digital assets moving forward.

Conclusion: What This Means for Chile and Beyond

The recent decision by the Central Bank of Chile to reject bitcoin as a reserve asset signals a cautious approach towards the integration of cryptocurrency into the country’s financial system. This stance reflects the bank’s prioritization of stability and risk management, especially in the face of the volatile nature of cryptocurrencies like bitcoin. By not recognizing bitcoin as a reserve asset, the Central Bank is likely attempting to avoid potential disruptions that could arise from significant price fluctuations typical of the cryptocurrency market.

This decision may influence the perception of cryptocurrency within Chile and across Latin America. The Central Bank’s rejection suggests a conservative attitude towards digital currencies, which may impact the broader adoption of blockchain technology in the region. While many countries are exploring or adopting cryptocurrencies, Chile’s approach may deter some potential investors who are looking for a stable regulatory environment. Without the backing of major financial institutions, the integration of btc and its platforms into conventional banking could face significant hurdles.

However, this does not entirely preclude the future of cryptocurrencies in Chile. The decision may encourage innovation and adaptations within the local fintech landscape, as various stakeholders seek to balance regulatory compliance while offering cryptocurrency-related services. This could lead to the emergence of alternative financial solutions, which remain flexible to the evolving dynamics of the cryptocurrency market. In conclusion, the Central Bank of Chile’s current position serves as a pivotal element in both national and regional considerations surrounding cryptocurrency, possibly shaping the future trajectory of digital assets and their roles in the financial ecosystem of Latin America.